FinTech, or Financial Technology, is transforming how people manage money. By using mobile apps, AI, blockchain, digital wallets, and automation, it makes banking, payments, lending, and investing faster, safer, and more accessible. Millions rely on FinTech services daily, from mobile banking to crypto platforms. It reduces costs, improves security, and supports financial inclusion worldwide.

Financial Technology, or FinTech, is changing the way people use money every day. It makes banking, payments, investing, and lending faster and easier through digital tools. Today, millions of users depend on mobile wallets, online banking apps, digital payment systems, and automated financial services from companies like PayPal, Google Pay, Revolut, Stripe, Visa, and Mastercard.

FinTech is growing quickly because it solves real-life problems in traditional banking. It reduces manual work, lowers service costs, improves online security, and supports financial inclusion for people in different regions. With technologies like AI in finance, blockchain systems, API banking, digital identity verification, cloud computing, and mobile-first banking, FinTech is creating safer and smarter financial experiences.

What is FinTech?

FinTech, or Financial Technology, uses digital tools to improve financial services. It helps people send money, make payments, invest, borrow, and manage their finances in a faster and safer way. FinTech combines mobile apps, automation, cloud computing, data analytics, artificial intelligence, and blockchain systems to create smooth digital experiences. These technologies work with traditional banks to support modern financial services. Most people already use financial technology every day without realizing it.

Here are some simple examples of FinTech applications:

-

Sending money through PayPal, Google Pay, or Apple Pay

-

Investing on platforms like Robinhood, eToro, and Wealthfront

-

Getting instant loans from digital lending apps

-

Buying or trading cryptocurrency on Binance or other crypto exchanges

FinTech is growing because it solves real problems in today’s financial world. It reduces manual work, lowers service costs, improves online security, and gives users more control over their money. These benefits make financial technology a core part of digital finance, financial innovation, online money services, and modern banking systems.

FinTech continues to expand as more people shift to mobile banking, contactless payments, and digital identity verification.

Why is FinTech important?

FinTech is important because it brings speed, convenience, and accessibility to the financial world. It removes many of the barriers that traditional banks could not solve. As digital finance continues to grow globally, reports from organizations like the World Bank, IMF, and global financial technology adoption studies show a rapid shift toward technology-driven financial services.

Here are the key reasons FinTech matters:

1. Makes financial services accessible

FinTech allows people to send money, invest, save, and borrow using just a smartphone. There is no need to visit a physical bank. This supports financial inclusion, especially in underserved regions. Digital inclusion reports show that millions are joining the formal financial system through FinTech apps.

2. Offers faster and cheaper solutions

Digital payments, P2P transfers, automated workflows, and online banking reduce service costs and eliminate long processing times. Users get instant payments, simple onboarding, and lower fees compared to traditional banking.

3. Helps businesses grow

FinTech gives SMEs access to tools that improve daily operations. Online payment gateways, POS devices, digital bookkeeping, e-commerce integrations, and digital lending platforms help businesses scale faster. These tools support cashless transactions, better financial management, and stable business growth.

4. Reduces fraud and enhances security

FinTech improves security through advanced tools such as AI-driven fraud detection, biometric authentication, encryption, and real-time risk monitoring. These methods protect user data, reduce financial crime, and build trust in digital ecosystems.

Financial Technology continues to play a major role in financial innovation, digital transformation, and the global shift toward smarter, more inclusive financial systems.

How does FinTech work?

FinTech works by combining different digital technologies to deliver faster, smarter, and safer financial services. These technologies automate traditional banking processes and create seamless digital experiences for users. Here are the core components that power modern fintech applications:

1. Cloud Computing

Cloud computing stores and processes financial data at scale. It helps banks and FinTech companies run services efficiently without heavy physical infrastructure. Cloud platforms also support real-time transactions and data security.

2. APIs (Application Programming Interfaces)

APIs connect banks, financial apps, and third-party platforms. They are essential for API banking and Open Banking, where secure data sharing allows users to access digital wallets, payment gateways, and budgeting apps through a single ecosystem. APIs make integrations faster and more secure.

3. Artificial Intelligence & Machine Learning

AI and ML drive many innovations in AI in finance. They are used for fraud detection, credit scoring, customer support chatbots, and personalized financial recommendations. AI analyzes patterns, reduces risk, and improves decision-making in digital finance.

4. Blockchain & Distributed Ledger Technology

Blockchain systems create transparent, secure, and tamper-proof digital records. They support cryptocurrency transactions, smart contracts, asset tokenization, and decentralized finance (DeFi). Blockchain technology builds trust in online financial processes by preventing unauthorized changes.

5. Mobile Technology

Mobile technology allows people to access financial services on the go. Smartphone apps enable digital payments, savings, investments, and digital onboarding. Features like digital identity verification make account opening faster and more secure.

Financial Technology works by connecting all these technologies into one ecosystem, making financial services automated, accessible, and secure for both individuals and businesses.

What are the pros and cons of FinTech?

FinTech brings powerful advantages by using modern technologies such as AI in finance, API banking, blockchain systems, and digital identity verification. These tools make financial services faster, safer, and easier to access. The benefits of financial technology can be seen in how it helps consumers make smarter financial decisions and enables businesses to automate payments, reduce operational costs, and improve overall customer experience.

However, FinTech also faces challenges, including cybersecurity risks, regulatory pressure, and the digital divide. The table below highlights the key pros and cons to help you understand the full picture.

Pros and Cons of FinTech

| Category | Pros | Cons |

|---|---|---|

| Speed & Efficiency | Faster payments and real-time transactions | Technical glitches and downtime |

| Accessibility | Easy access through mobile banking and online platforms | Limited access for users with low digital skills or poor internet |

| Automation & Cost Savings | Lower service costs due to automation | High dependency on technology |

| Security & Fraud Prevention | Better fraud detection with AI in finance | Cybersecurity risks and data breaches |

| User Verification & Onboarding | Quick onboarding with digital identity verification | Privacy concerns around user data |

| Business Growth & Integrations | Improved operations through API banking, POS systems, and digital tools | Complex regulations and compliance requirements |

| Transparency & Trust | More secure and transparent transactions through blockchain systems | Crypto and blockchain volatility |

What are the different types of FinTech?

FinTech includes many categories that work together to improve how we pay, save, invest, borrow, and manage money. These fintech applications use modern technologies such as mobile apps, automation, API integrations, and digital identity systems. Together, they support the global move toward online banking, smarter financial services, and powerful payment technology.

Below are the major types of financial technology and how they function in the digital finance ecosystem.

1. Digital Payments

Digital payments are the backbone of FinTech.

They allow people to send and receive money instantly without cash. This category includes:

-

Mobile wallets (Google Pay, Apple Pay)

-

QR code payments

-

Contactless payments (NFC)

-

Online checkout systems for e-commerce

Digital payments also support financial automation, reducing manual tasks for businesses like invoicing, settlements, and reconciliation. This is the most widely adopted form of FinTech worldwide.

2. Digital Lending

Digital lending platforms make borrowing fast and easy.

Users can apply for loans online, get evaluated using AI-driven credit scoring, and receive funds quickly. This category covers:

-

Personal loans

-

Business loans for SMEs

-

BNPL (Buy Now, Pay Later)

-

P2P lending platforms

-

Salary advance apps

These services help people access credit without visiting traditional banks and reduce long approval times.

3. WealthTech

WealthTech focuses on helping people grow their money.

It uses smart algorithms and automation to make investing easier for beginners and professionals. Examples include:

-

Robo-advisors that manage portfolios

-

Investment apps for stocks, ETFs, and bonds

-

Automated trading tools

-

Portfolio tracking dashboards

-

Financial planning platforms

WealthTech supports the rising trend of digital investing, giving users more control and transparency.

4. InsurTech

InsurTech brings digital transformation to the insurance industry.

It simplifies buying, comparing, and managing insurance policies. Key innovations include:

-

Online policy comparison

-

Instant digital insurance

-

Mobile-based claim filing

-

Usage-based insurance (pay-as-you-go)

-

AI-based risk assessment

These tools reduce paperwork, improve customer experience, and speed up claims.

5. RegTech

Regulatory Technology helps financial companies meet compliance rules. This is critical because financial institutions must follow strict regulations to prevent fraud and protect user data. RegTech tools include:

-

Automated identity verification

-

AML/KYC checks

-

Real-time monitoring

-

Fraud detection

-

Reporting tools

RegTech reduces human error, makes compliance faster, and keeps companies aligned with global financial regulations.

6. Crypto & Blockchain

This category uses blockchain systems to support secure, transparent, and decentralized financial services. It includes:

-

Cryptocurrency exchanges

-

DeFi (Decentralized Finance) apps

-

Tokenization platforms

-

Smart contract systems

-

Digital asset storage (wallets)

Blockchain removes the need for intermediaries and offers a new model for digital ownership and financial transactions.

7. Neobanking

Neobanks are completely digital banks with no physical branches.

They offer banking services through mobile apps and web platforms. Features include:

-

Digital account opening

-

Instant transfers

-

Virtual debit cards

-

Multi-currency wallets

-

Savings and budgeting tools

Neobanks are popular for their low fees, fast service, and user-friendly design—ideal for people who prefer online banking.

8. Personal Finance Apps

These apps help individuals manage daily money tasks.

They provide insights and tools such as:

-

Budget tracking

-

Expense categorization

-

Savings goals

-

Subscription management

-

Bill reminders

These apps encourage better financial habits and give users full visibility of their spending.

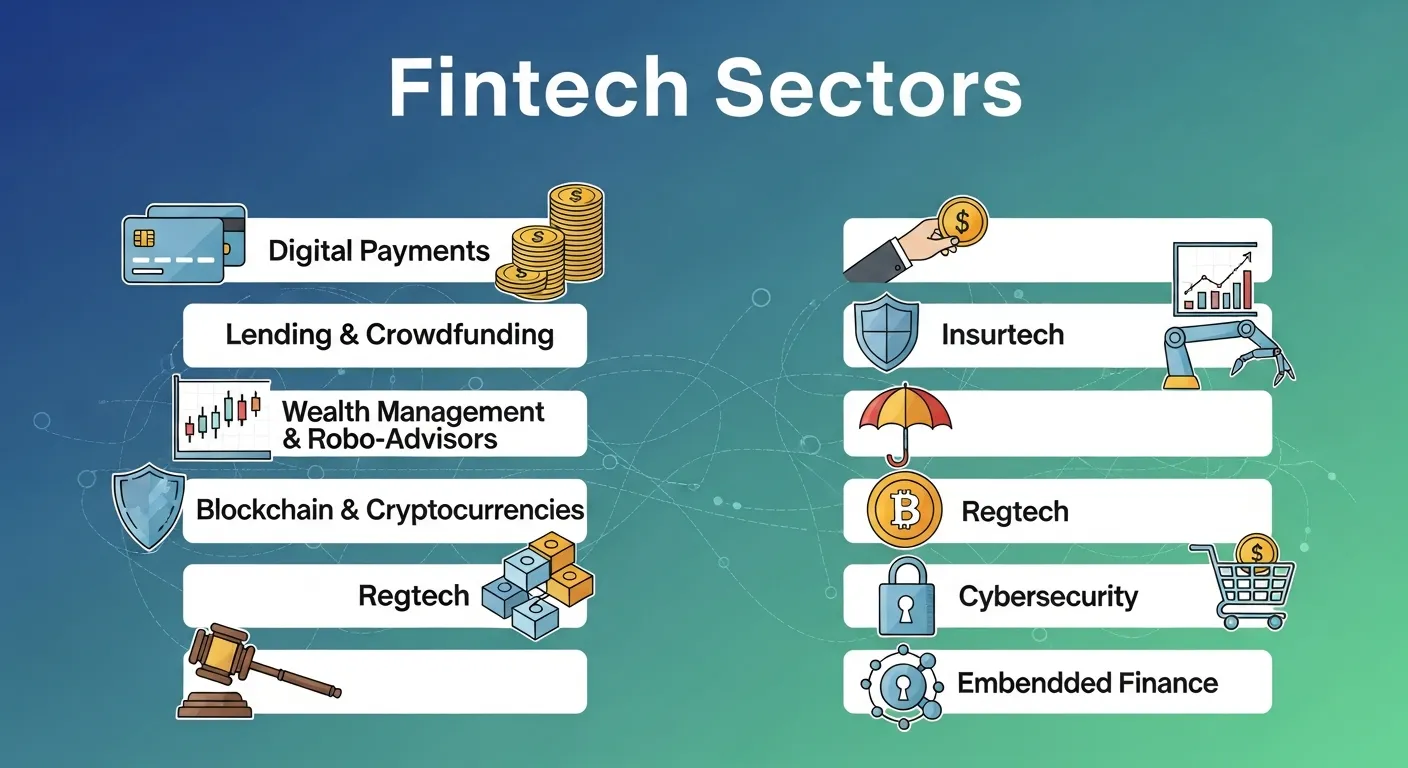

What are the different fintech sectors?

FinTech covers several major sectors that use technology to make financial services faster, safer, and easier for people and businesses. Today’s financial ecosystem is powered by tools like AI in finance, blockchain systems, payment technology, and API banking. Global companies such as Visa, Mastercard, Stripe, Revolut, and Ant Financial are leading this transformation.

Below are the core FinTech sectors shaping modern finance.

1. Banking Sector

The banking sector has changed rapidly with online banking, digital KYC, and automated account services. Banks now use API banking and digital identity verification to make onboarding and money transfers simple. Mobile-first banks like Revolut and other neobanks offer seamless digital services without physical branches, making banking more accessible and efficient.

2. Payments Sector

The payments sector is one of the fastest-growing areas in FinTech. Companies such as Visa, Mastercard, Stripe, and Square enable secure mobile wallets, QR payments, and instant P2P transfers. This payment technology helps customers send money quickly and supports businesses with faster checkout, digital remittance, and automated billing.

3. Insurance Sector (InsurTech)

InsurTech is modernizing insurance by using AI-powered risk scoring, digital claim processing, and automated underwriting. Customers can buy insurance, submit claims, and get decisions entirely online. These digital tools reduce paperwork, lower fraud, and improve customer experience.

4. Investment & Trading Sector (WealthTech)

WealthTech platforms offer digital investing through robo-advisors, automated portfolios, and algorithmic trading tools. Platforms like Robinhood, eToro, and Wealthfront make investing simple for beginners by giving real-time data, low fees, and easy-to-use apps. These tools help users grow wealth with smart, automated financial decisions.

5. Lending Sector

Digital lending has made borrowing easier and faster. Online platforms offer personal loans, SME loans, microcredit, and BNPL services. Many lenders use AI credit scoring and open banking data to approve applications quickly. BNPL companies like Klarna and Afterpay allow customers to buy products and pay in installments without extra fees.

6. Personal Finance Sector

Personal finance apps help people manage their money better. Tools like Mint and YNAB use automation and analytics to track expenses, create budgets, and support financial wellness. These apps make financial planning simple and help users build healthy money habits.

What is the future of FinTech?

The future of FinTech is moving toward a more intelligent, automated, and connected financial world. As global institutions like the World Bank, IMF, and the Bank for International Settlements (BIS) continue to support digital transformation, financial technology is shaping the future of finance and driving massive change in the global digital economy.

New technologies such as AI-driven banking, blockchain innovation, and smart financial automation are redefining how people and businesses interact with money.

Here are the major FinTech trends that will define the next decade.

1. AI-First Financial Services

AI will play a central role in the next stage of financial innovation. Banks and FinTech leaders like Ant Financial, Revolut, and major payment networks such as Visa and Mastercard are already using AI to deliver personalized banking, faster loan approvals, and real-time fraud prevention.

This shift toward AI-driven banking will give users instant decisions, smarter financial insights, and stronger security.

2. Embedded Finance

Embedded Finance will blend financial services into everyday non-financial apps. E-commerce platforms, ride-sharing apps, food delivery services, and travel apps will offer payments, lending, investments, and insurance directly inside their ecosystems.

This model reduces friction and expands technology adoption across industries, allowing users to access financial services without opening multiple apps.

3. Expansion of Open Banking

Open Banking will continue to grow as more countries adopt secure data-sharing frameworks supported by global regulators. Through API-based integrations, banks and FinTech companies can create smoother digital experiences.

Users will manage multiple accounts in one dashboard, get automated financial advice, and access transparent loan and credit options. This trend accelerates digital transformation in finance worldwide.

4. Rise of Central Bank Digital Currencies (CBDCs)

Many governments are developing CBDCs as part of their national digital strategies. Countries working closely with the BIS and other financial authorities are testing digital versions of their currencies to modernize payments, improve traceability, and support financial inclusion.

CBDCs will make cross-border payments faster, cheaper, and more secure.

5. Growth of Web3 and Decentralized Finance (DeFi)

The next phase of FinTech includes Web3, which introduces decentralized applications, tokenized assets, and smart contracts. DeFi platforms eliminate middlemen and allow peer-to-peer lending, trading, and investing.

Blockchain systems and digital identity frameworks will support secure, transparent financial operations. This trend will bring both innovation and regulatory challenges.

6. Hyper-Personalized Financial Experiences

AI and big data analytics will give users highly customized financial experiences. Apps will provide personalized investment ideas, real-time spending insights, goal-based automation, and smart savings strategies.

This personalization trend will help users make better financial decisions and will push FinTech companies to build more powerful financial automation tools.

Conclusion

FinTech is no longer just a trend—it is a global financial revolution that is transforming the future of finance. From digital payments and online lending to InsurTech, WealthTech, and blockchain innovation, FinTech is changing how people save, spend, and invest. Companies like Visa, Mastercard, Stripe, Revolut, and Ant Financial continue to push this digital transformation forward, making financial services smarter and more accessible.

As the digital economy expands, technologies such as AI-driven banking, open banking, embedded finance, and decentralized finance (DeFi) will unlock even more opportunities. These innovations will help individuals make better financial decisions and give businesses powerful tools for automation and growth.

Financial Technology will keep evolving, creating a future where financial services are faster, safer, and truly inclusive for everyone.

FAQs – FinTech Beginners Guide

1. What is FinTech mean?

FinTech (Financial Technology) uses digital tools to improve banking, payments, investing, lending, insurance, and personal finance.

2. Why is FinTech important?

It makes financial services faster, safer, cheaper, and more accessible for individuals and businesses.

3. How does FinTech work?

FinTech combines AI, blockchain, cloud computing, mobile apps, and APIs to automate and streamline financial services.

4. What are the main types of FinTech?

-

Digital Payments: Mobile wallets, online payments

-

Digital Lending: Online loans, BNPL, P2P lending

-

WealthTech: Robo-advisors, investment apps

-

InsurTech: Digital insurance, AI risk assessment

-

RegTech: Compliance automation, fraud detection

-

Crypto & Blockchain: Cryptocurrencies, DeFi

-

Neobanking: Mobile-only banks

-

Personal Finance Apps: Budgeting, expense tracking

5. What are the benefits of FinTech?

Faster transactions, lower fees, better security, automation, financial inclusion, and smarter money management.

6. What are the challenges of FinTech?

Cybersecurity risks, regulatory compliance, tech dependence, and limited access for low-tech users.

7. How is AI used in FinTech?

For fraud detection, credit scoring, chatbots, and personalized financial advice.

8. What is embedded finance?

Financial services built into non-financial apps like e-commerce, ride-sharing, or travel platforms.

9. Are digital banks part of FinTech?

Yes. Neobanks operate fully online with mobile transfers, virtual cards, and savings tools.

10. How does FinTech help investing?

Through robo-advisors, automated portfolios, and investment apps that provide real-time data and easy management.

11. How does FinTech promote financial inclusion?

By giving mobile access to banking, lending, and payments in underserved areas.

12. What is the future of FinTech?

AI-driven, automated, connected finance with embedded services, blockchain, digital currencies, and personalized experiences.

Quantum Computing in Finance: Revolutionizing Banking’s Tomorrow

What Is Financial Technology (FinTech)? Everything You Need to Know

The Role of AI in Digital Financial Decision Making

Harnessing AI and Machine Learning for Fraud Detection in Digital Finance

Digital Twin Technology in Finance: How Virtual Models Are Transforming Risk Management

The Future of Personal Finance: Autonomous Finance and AI Money Management

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

AI Fraud Detection: How Banks Prevent Financial Crime in Real Time