The world of financial services is changing fast. Traditional banking once relied on closed systems and limited data sharing. Today, that model is shifting toward open banking, an interconnected financial ecosystem powered by secure APIs (Application Programming Interfaces). With customer consent, banks can safely share financial data with fintech companies, payment service providers, and other third-party platforms.

Open banking creates more competition, faster innovation, and better digital experiences. It enables personalized financial services, easier access to credit, real-time payments, smart budgeting tools, and cost-efficient solutions for both consumers and businesses. This shift supports financial inclusion, transparency, and user control.

In this guide, we will walk through the core principles of open banking, the key technologies behind it, major benefits, global regulatory frameworks like PSD2, UK Open Banking Standard, and Australia’s CDR, real-world use cases, and the future trends shaping the next phase of digital finance.

Stay with us as we explore how open banking is reshaping the way people interact with money, banks, and financial ecosystems worldwide.

What Is Open Banking?

Open banking is a digital finance system where banks share customer-approved data with licensed third-party providers using secure and standardized APIs. These APIs give access to basic financial information such as account balances, transaction history, and payment initiation. This is different from traditional banking, where all data stayed locked inside separate systems controlled only by the bank.

In open banking, financial institutions act like data platforms. They enable collaboration with fintech companies, digital wallets, neobanks, payment service providers (PSPs), and other trusted partners. This creates smarter tools and more innovative services.

Customers stay fully in control. They choose what data to share and who can access it. This helps users compare financial products, get personalized money advice, use automated budgeting apps, make faster digital payments, and manage multiple bank accounts in one place. Open banking increases transparency, improves user experience, and strengthens the digital finance ecosystem.

How Open Banking Works?

Open banking works by allowing banks to share customer-approved data with trusted third-party providers through secure APIs. These APIs act as digital pipelines that transfer financial information safely and in real time.

1. Customer Gives Consent

The process begins when a user approves a request from a fintech app, digital wallet, or another licensed provider. Customers choose exactly what data they want to share.

2. Bank Verifies the Request

The bank checks the identity of the third-party provider using strict security standards such as OAuth 2.0 and Strong Customer Authentication (SCA).

3. Secure Data Transfer via APIs

Once approved, the bank sends the required data—like balances or transactions—through encrypted API connections.

4. Third Party Uses the Data to Provide Services

Fintech apps use this data to create personalized financial tools such as budgeting apps, spending insights, loan offers, or payment services.

5. Customer Remains in Control

Users can pause, limit, or revoke data access at any time through consent dashboards provided by the bank or the app.

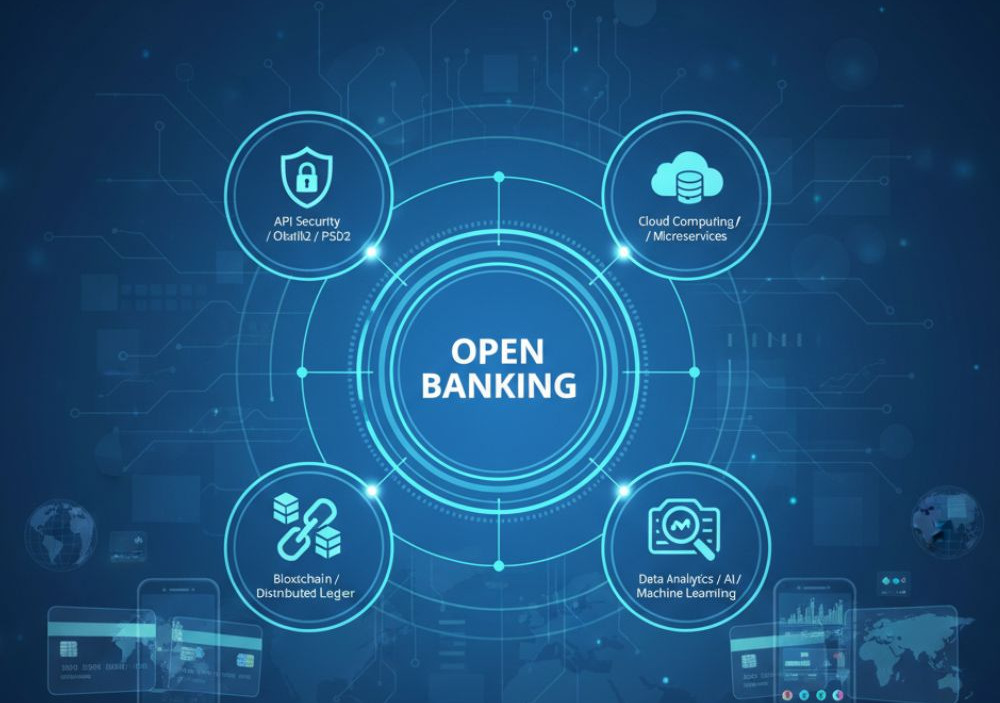

Key Technologies Behind Open Banking

Open banking runs on several core technologies that make digital finance secure, fast, and connected.

1. Secure APIs

Secure APIs are the backbone of open banking. These RESTful APIs use JSON or XML formats to share financial data safely between banks and trusted third-party providers. This standardized data exchange helps create smooth integrations for fintech apps, digital wallets, and neobanks. Secure API infrastructure also reduces errors and supports real-time financial services.

2. OAuth 2.0 and OpenID Connect

Open banking relies on OAuth 2.0 and OpenID Connect to manage authentication and authorization. These technologies let users approve access without sharing passwords, supporting Strong Customer Authentication (SCA). This protects accounts from unauthorized access and keeps identity verification secure inside the financial ecosystem.

3. Tokenization and Encryption

Sensitive banking data is protected using tokenization and strong TLS encryption. These security methods keep personal and payment information safe during transfers and while stored. Tokenization replaces real account details with secure digital tokens, reducing fraud risks. Encryption ensures data cannot be intercepted or tampered with.

4. Cloud Computing

Modern open banking platforms use cloud computing to scale quickly and handle high transaction volumes. Cloud services like AWS, Google Cloud, and Microsoft Azure provide reliability, uptime, and resilience. This cloud-native approach supports digital transformation and ensures fintech services work smoothly even during peak demand.

5. AI and Advanced Analytics

Artificial intelligence plays a major role in open banking innovation. Machine learning models analyze real-time financial data to deliver personalized insights, smarter budgeting tools, and automatic fraud detection. Advanced analytics convert raw banking data into meaningful guidance that improves user experience and supports better financial decision-making.

Benefits for Consumers

Open banking gives consumers many powerful advantages in their daily financial lives. It helps users take control of their money through secure, easy, and connected digital services.

1. Unified Financial Overview

Open banking lets people connect multiple bank accounts into one dashboard. This unified view helps users understand their income, expenses, and savings clearly. It also makes budgeting easier because all financial data is shown in real time. Apps connected through Open Banking APIs, PSD2, or UK Open Banking can provide accurate financial snapshots with minimal effort.

2. Personalized Financial Insights

Consumers get personalized recommendations based on their spending behavior. AI-powered finance apps, robo-advisors, and personal finance management tools (PFMs) use open banking data to identify patterns, suggest savings plans, and send alerts for unusual transactions. This makes money management smarter and more proactive.

3. Faster and Cheaper Payments

With Payment Initiation Services (PIS), users can make secure bank-to-bank payments directly from third-party apps. These transfers are often cheaper than traditional card payments and offer faster settlement times. This improves the checkout experience for online shopping, bill payments, and P2P transfers.

4. Transparent Loan and Credit Access

Open banking makes it easier to compare loans, credit cards, and mortgage rates. Lenders use real-time bank data to offer fair and personalized credit decisions. People with limited credit history benefit from cash-flow-based evaluations instead of only traditional credit scores. This supports greater financial inclusion.

5. Better Control and Financial Freedom

Consumers choose exactly what data they want to share and with whom. Clear consent flows, supported by OAuth 2.0, SCA, and regulated Account Information Services (AIS), ensure safety and transparency. People can revoke access anytime through consent dashboards, giving them full control over their digital footprint.

6. Increased Competition and More Choices

Open banking encourages innovation among fintech companies, neobanks, and traditional banks. More competition leads to better apps, lower fees, and more tailored financial products. This improves customer experience and empowers individuals to choose services that match their needs.

7. Improved Financial Well-Being

By combining data, personalization, and transparency, open banking helps users make smarter financial decisions. They can track goals, avoid unnecessary fees, reduce debt, and plan for the future more effectively. This boosts overall financial stability and well-being.

Benefits for Businesses and Fintechs

Open banking offers powerful benefits for businesses, SMEs, fintech startups, and financial institutions. It helps companies work faster, reduce costs, and create better digital financial services.

1. Automated Accounting and Cash Flow Management

Small and medium-sized enterprises (SMEs) can connect their bank accounts directly with accounting platforms like QuickBooks, Xero, or Zoho Books through Open Banking APIs.

This integration automates invoicing, reconciliation, and cash flow forecasting. Businesses save time, reduce manual errors, and get real-time financial insights.

2. Better Credit Scoring and Faster Lending

Lenders and digital loan platforms can access real-time banking data using Account Information Services (AIS).

They can analyze income, spending patterns, and cash flow to build more accurate credit scoring models.

This helps extend loans to underserved or thin-file customers, supporting SME financing and financial inclusion.

3. Faster Product Development for Fintech Startups

Fintech companies can build new financial apps without needing a full banking license.

Using regulated APIs under PSD2, UK Open Banking, or regional frameworks, fintechs get faster time-to-market.

They can focus on user experience while relying on secure bank infrastructure for payments, authentication, and data access.

4. New Revenue Streams for Banks

Traditional banks can create new business models by joining open banking ecosystems.

They can earn revenue through:

-

Premium API tiers

-

Data analytics services

-

White-label digital banking solutions

-

Partner marketplaces and integrations

This helps banks stay competitive and relevant in the age of open finance and digital transformation.

5. Stronger Collaboration and Innovation

Open banking encourages collaboration between banks, fintechs, payment service providers (PSPs), and neobanks.

This shared ecosystem speeds up innovation and allows rapid testing of new financial products.

Companies can improve product-market fit, deliver better customer experiences, and increase long-term loyalty.

6. Improved Security and Compliance

Businesses use standardized security protocols like OAuth 2.0, OpenID Connect, and Strong Customer Authentication (SCA).

This ensures safe data sharing, reduces fraud risk, and builds trust among users.

Security and Privacy Considerations

Security and privacy are critical in open banking. Because financial data is sensitive, banks and third-party providers (TPPs) must follow strict rules under frameworks like PSD2 (European Union), the UK Open Banking Standard, and other global open finance regulations. These rules help protect users and reduce risks.

Open banking systems use multi-factor authentication (MFA) and Strong Customer Authentication (SCA) to verify user identity. This includes methods like biometrics, one-time passwords, or device verification. Continuous monitoring and real-time fraud detection tools help identify unusual activity quickly.

To keep data safe, open banking platforms use encryption technologies such as TLS, tokenization, and secure authorization methods like OAuth 2.0 and OpenID Connect. These tools prevent unauthorized access and protect information during data transfers.

Privacy is protected through data minimization, meaning only necessary data is collected. Users can control what information they share through consent dashboards, where they can review, limit, or revoke access anytime.

Emerging privacy-preserving technologies—like differential privacy, homomorphic encryption, and secure data vaults—allow companies to analyze financial trends without exposing personal details. These innovations make open banking safer and more trustworthy.

By combining transparency, strong security protocols, and regulatory compliance, the open banking ecosystem can deliver innovation while keeping consumer data fully protected.

Regulatory Landscape

Regulation is a key driver of open banking. In the European Union, the PSD2 (Revised Payment Services Directive) requires banks to give licensed third-party providers secure API access. These providers must meet strict rules for authentication, data privacy, and supervision. In the UK, the Open Banking Implementation Entity (OBIE) sets technical API standards, security guidelines, and customer experience requirements.

Other countries—including Australia with its Consumer Data Right (CDR), Canada, Singapore, and several Asian markets—are building similar open finance frameworks. Although the rules differ by region, regulators share the same goals: protecting consumers, encouraging competition, and supporting financial innovation.

To achieve this, regulators enforce strong licensing processes, data protection laws, dispute resolution mechanisms, and clear compliance checks. They also promote secure practices like Strong Customer Authentication (SCA) and standardized API formats.

Cross-border open banking is still challenging because global rules are not fully harmonized. Continuous collaboration between banks, fintech companies, API providers, and regulators helps address issues like digital identity, KYC, customer consent, cross-institution data sharing, and credit risk.

By creating unified standards and clear guidelines, regulators are shaping a safer, more transparent, and more innovative open banking ecosystem worldwide.

Real-World Use Cases

Open banking is already enabling transformative applications across retail and corporate finance. Personal finance management apps like Yolt and Emma provide spending insights and budgeting tools by aggregating multiple accounts. Digital lenders use account transaction histories to underwrite small loans in minutes, reaching gig economy workers who lack traditional credit files. Accounting platforms like Xero and QuickBooks integrate bank feeds for real-time bookkeeping and automated reconciliation. E-commerce platforms harness payment initiation APIs to offer one-click checkout directly from a consumer’s bank account, reducing cart abandonment rates. Corporate treasury teams leverage aggregated cash flow data to optimize working capital management. These examples demonstrate how open banking is not just a theoretical concept but a live catalyst for efficiency and customer-centric innovation.

Future Trends in Open Banking

The next phase of open banking will be shaped by several powerful trends. One major development is embedded finance, where non-financial brands—such as e-commerce platforms, ride-hailing apps, and retail marketplaces—offer financial services directly inside their user experience using open banking APIs. This makes banking more seamless and accessible.

Another fast-growing trend is Banking-as-a-Service (BaaS). BaaS platforms allow startups and fintech companies to launch digital banking products, wallets, and payment tools without needing a full banking license. This accelerates innovation across the fintech ecosystem.

We will also see more overlap between decentralized finance (DeFi) and regulated banking. Hybrid models may combine the trust of licensed financial institutions with blockchain-based programmability for secure, transparent data sharing and automated financial workflows.

AI-driven personalization will become more advanced, offering proactive budgeting tips, smart spending alerts, and predictive financial guidance based on real-time transaction data. This will improve customer experience and financial well-being.

Lastly, efforts toward global API standardization—led by organizations in the EU, UK, Australia, and Asia—will improve cross-border data sharing, global payments, and digital identity verification. This will help build a borderless digital finance ecosystem, where customers can move their data and money easily and securely anywhere in the world.

Conclusion

Open banking is transforming modern digital finance by opening secure data-sharing between banks, fintech companies, third-party providers (TPPs), and consumers through standardized APIs. This new model strengthens financial transparency, improves customer experience, and encourages innovation across the banking ecosystem.

By adopting open banking frameworks such as PSD2, UK Open Banking, and global Consumer Data Right (CDR) regulations, financial institutions can build safer, more compliant, and more connected services. These frameworks ensure strong data security, customer consent, and identity verification, creating a trusted environment for API-powered financial interactions.

Looking forward, open banking will merge with future-shaping technologies. Embedded finance, Banking-as-a-Service (BaaS), and AI-driven personalization will provide customers with seamless financial services directly inside everyday apps. Cross-border API standardization and innovations in digital payments will push the ecosystem toward global interoperability. Even blockchain and DeFi may blend with regulated banking to create hybrid financial models.

For businesses and consumers, the opportunity is clear: open banking delivers more efficient, secure, and inclusive financial solutions. As the landscape evolves, staying aligned with regulatory standards, collaborating with trusted partners, and adopting modern API technologies will be essential to unlocking the full potential of open banking in the digital era.

FAQs

1. Is open banking safe for consumers?

Open banking is built on strict security frameworks like PSD2, SCA (Strong Customer Authentication), OAuth 2.0, and encrypted APIs. Only licensed third-party providers can access data, and users must give explicit consent. You can also revoke access anytime through consent dashboards.

2. What data can third-party providers access through open banking?

Third-party providers can access only the information you approve—such as account balances, transaction history, or payment initiation permissions. They cannot see your password or full account details, and they cannot make unauthorized changes to your bank account.

3. How do open banking payments work?

Open banking payments—also called Payment Initiation Services (PIS)—allow users to pay merchants directly from their bank account without cards. These payments use secure APIs, offer faster settlements, and often have lower processing fees than traditional card payments.

4. What are the main benefits of open banking for businesses?

Businesses gain from real-time financial data, automated accounting, cash flow insights, faster lending decisions, and cheaper bank-to-bank payments. SMEs can integrate accounting tools like Xero, QuickBooks, and fintech lenders can offer personalized, cash-flow-based credit.

5. What is the difference between open banking and open finance?

Open banking focuses on sharing bank account and payment data via secure APIs.

Open finance goes further—it includes loans, investments, insurance, pensions, credit data, and alternative financial information. Open finance builds a more complete and personalized digital financial ecosystem.

The Future of Personal Finance: Autonomous Finance and AI Money Management

The Role of AI in Digital Financial Decision Making

What Is Financial Technology (FinTech)? Everything You Need to Know

What is a Fintech Firm? Everything You Need to Know

Digital Twin Technology in Finance: How Virtual Models Are Transforming Risk Management

The Future of Personal Finance: Autonomous Finance and AI Money Management

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

AI Fraud Detection: How Banks Prevent Financial Crime in Real Time