Cyberattacks are hitting financial institutions at an alarming rate. Studies show that organizations face digital threats every 39 seconds. As digital banking, mobile payments, and online trading platforms continue to grow, traditional cybersecurity methods are struggling to keep up. In this environment, blockchain security in finance is emerging as a powerful solution. It offers stronger protection for sensitive data, safer transactions, and better fraud prevention.

This innovative technology is reshaping the future of financial cybersecurity. Unlike centralized banking databases that create single points of failure, blockchain builds a secure network of distributed nodes. This structure makes hacking extremely difficult. For fintech developers, banking professionals, and security analysts, understanding blockchain is no longer optional—it is essential for staying competitive in today’s fast-moving digital finance world.

Understanding Blockchain’s Role in Financial Security

Blockchain technology is changing how the financial world thinks about cybersecurity. Traditional banking systems store all customer data in one central database. This creates an easy target for cybercriminals, because a single breach can expose huge amounts of sensitive financial information.

A distributed ledger system works very differently. It spreads data across many network nodes, and every transaction must be approved through consensus mechanisms before it becomes valid. This removes single points of failure and makes unauthorized access much harder to achieve.

Blockchain is also protected by strong cryptographic hashing, which adds another layer of security. Each block carries a unique hash linked to the previous block, creating an unbreakable chain of records. To change any older transaction, a hacker would need to alter every block that comes after it—something that is nearly impossible and instantly detectable.

This architecture gives financial institutions a safer, more transparent, and more reliable way to protect digital assets and customer data.

Key Blockchain Security Features Transforming Digital Finance

Immutable Transaction Records

Blockchain security ensures that financial data is permanently recorded and cannot be altered. Once a transaction is validated by the network, it becomes part of an immutable ledger. This prevents fraud, reduces disputes, and provides a clear audit trail that regulators and compliance teams can trust.

Banks using blockchain report fewer financial disputes. The transparent nature of blockchain records allows all parties to independently verify transaction details, removing confusion and disagreements common in traditional financial systems.

Advanced Encryption Protocols

Blockchain security uses strong cryptography to protect sensitive financial information. Every transaction receives a digital signature through public-private key encryption, ensuring that only authorized users can access or transfer funds.

This encryption works automatically in the background, providing military-grade protection without extra steps for users. As a result, secure digital transactions become as easy as traditional banking, but with much stronger protection against cyberattacks.

Decentralized Consensus Mechanisms

A core part of blockchain security is the consensus mechanism. Before any transaction is approved, multiple network participants must agree on its validity. This makes it extremely difficult for attackers to manipulate financial records or approve fraudulent transactions.

The decentralized system also enables real-time fraud detection. Suspicious activity or unauthorized access triggers immediate alerts across the network, allowing financial institutions to respond in seconds rather than hours or days.

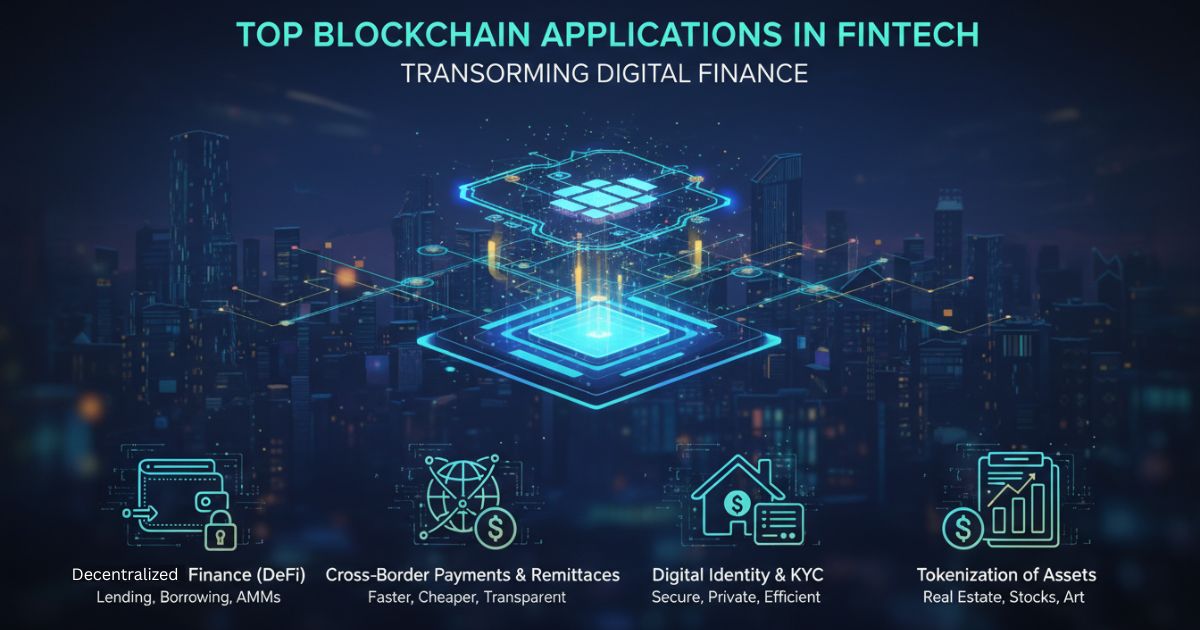

Top Blockchain Applications in Fintech Transforming Digital Finance

Anti-Fraud Systems

Blockchain is transforming how financial institutions prevent fraud. Traditional fraud detection tools depend on pattern analysis and historical data. While useful, these systems can trigger false alerts and sometimes miss advanced cybercrime attempts.

With blockchain fintech solutions, fraud prevention becomes stronger. Smart contracts automatically enforce security protocols, and the distributed ledger makes it nearly impossible for fraudsters to alter or hide transaction data. This builds a trusted and fraud-resistant financial ecosystem.

Supply Chain Finance Security

Blockchain technology enhances data integrity in supply chain finance and trade finance. Multi-party financial processes involve complex data exchanges, increasing operational risk.

On a blockchain network, each step is verified using cryptographic validation, ensuring complete transaction transparency. This helps institutions meet strict regulatory compliance standards and reduces errors or manipulation in financial workflows.

Digital Identity Verification

Blockchain is revolutionizing digital identity management in finance. Instead of storing sensitive data in centralized databases, it creates decentralized identity systems, giving users full control over their personal information.

Customers can verify their identity for digital banking or financial services without exposing sensitive details. This reduces identity theft, speeds up customer onboarding, and strengthens overall cybersecurity. Digital identity verification on blockchain ensures safer, more transparent, and reliable financial operations.

Cross-Border Payments & Remittances

Blockchain payments are simplifying international money transfers. Traditional remittances often involve delays, high fees, and multiple intermediaries.

By removing middlemen, blockchain allows banks and fintech platforms to transfer funds across borders quickly and securely. Users benefit from lower costs, faster settlement times, and real-time transaction tracking, while institutions gain stronger fraud prevention.

Smart Contract Lending & DeFi Platforms

Blockchain supports automated lending systems using smart contracts. These contracts enforce loan terms on the distributed ledger, reducing errors and eliminating manual intervention.

Borrowers get faster approvals, lenders minimize credit risks, and fintech companies cut operational costs. Decentralized finance (DeFi) platforms are leveraging these solutions to provide loans without relying on traditional banking systems.

Real-Time Auditing & Compliance

Financial institutions must meet strict auditing and compliance requirements. Blockchain technology enables real-time transaction auditing, offering full transparency into every financial activity.

Because every record is immutable and tamper-proof, banks can prove regulatory compliance, reduce reporting errors, and streamline internal audits. This strengthens trust with regulators and supports secure digital finance operations.

Blockchain continues to unlock new applications in fintech, enhancing cybersecurity, transaction transparency, and operational efficiency. As digital banking grows, these real-world use cases show how blockchain is transforming the entire financial ecosystem.

Overcoming Implementation Challenges

Scalability Solutions

Early blockchain networks faced transaction speed limitations that seemed incompatible with high-volume financial operations. Modern fintech blockchain applications address these concerns through layer-2 solutions and improved consensus algorithms that process thousands of transactions per second without compromising security.

Financial institutions now deploy hybrid blockchain systems that combine the security benefits of distributed ledgers with the speed requirements of modern banking operations.

Regulatory Compliance

Blockchain digital finance must navigate complex regulatory landscapes that vary by jurisdiction. Forward-thinking financial institutions work closely with regulators to ensure their blockchain implementations meet all compliance requirements while maximizing security benefits.

This collaborative approach is creating new regulatory frameworks specifically designed for blockchain-based financial services, paving the way for broader adoption across the industry.

Integration with Legacy Systems

Most financial institutions operate sophisticated legacy systems that handle millions of transactions daily. Successful blockchain implementation requires careful integration that maintains operational continuity while adding enhanced security layers.

Modern blockchain solutions offer API connectivity and middleware that allow seamless integration with existing financial infrastructure, making adoption more practical for established institutions.

The Future of Blockchain Security in Finance

Emerging technologies will bring even stronger protection to digital finance. Quantum-resistant cryptography is now being added to blockchain protocols to guard against future quantum computing threats. At the same time, machine learning algorithms are being integrated with blockchain networks to build predictive security systems. These platforms can detect risks early and stop cyberattacks before they harm financial operations.

Financial inclusion is also improving through blockchain security. New decentralized financial systems are helping deliver banking access to people in underserved regions. These systems work even where traditional banking networks are weak or unavailable, while still offering the same high ** cybersecurity standards** used in developed markets.

The future looks promising as blockchain continues to reshape financial security, boost trust, and support global access to secure digital banking.

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

Cross-Border Payment Solutions for Businesses – What SMBs Should Know

What Is Financial Technology (FinTech)? Everything You Need to Know

The Future of Personal Finance: Autonomous Finance and AI Money Management

Digital Twin Technology in Finance: How Virtual Models Are Transforming Risk Management

The Future of Personal Finance: Autonomous Finance and AI Money Management

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

AI Fraud Detection: How Banks Prevent Financial Crime in Real Time