Digital Twin Technology in Finance is emerging as a powerful solution for banks, insurance companies, fintech platforms, and investment firms. A digital twin is a virtual model that mirrors a real financial system, customer profile, or operational process. It updates in real time using data from core banking systems, market data feeds, risk analytics engines, and customer interaction points.

As financial markets become more volatile and global regulations tighten, financial institutions need more accurate and proactive risk strategies. A digital twin in financial services helps meet this demand by enabling real-time simulations, predictive risk insights, and scenario testing. These virtual models allow teams to understand system behavior, detect vulnerabilities, and prepare for different market outcomes.

Today, financial leaders—from risk managers, data scientists, and CROs (Chief Risk Officers) to CTOs—use digital twin models to strengthen resilience, improve forecasting, and streamline operations. They help reduce uncertainty, support compliance, and enhance overall decision-making.

This article explores how Digital Twin Technology in Finance is transforming modern risk management and why it is quickly becoming a core capability across the global financial services industry.

Digital Twin Technology in Finance means creating a virtual model of a financial product, portfolio, customer segment, or business process. This digital replica uses real-time data, AI-driven analytics, and predictive modeling to simulate outcomes, measure risks, and improve performance. Major financial institutions—such as JPMorgan Chase, Goldman Sachs, HSBC, and Allianz—are already using advanced simulation tools, cloud infrastructures, and AI risk engines, making digital twins the next major step in financial innovation.

What Is Digital Twin Technology in Finance?

Digital Twin Technology in Finance refers to building a virtual replica of a financial product, investment portfolio, customer segment, or internal business process. This digital model uses real-time financial data, AI analytics, machine learning, and predictive modeling to simulate outcomes, assess risks, and improve decision-making.

Leading financial institutions—such as JPMorgan Chase, Goldman Sachs, HSBC, and Allianz—already use advanced simulation models, cloud-based risk management systems, and AI-powered forecasting tools. Digital twins represent the next evolution of this technology, enabling more accurate stress testing, stronger risk controls, and smarter operational planning across the financial services industry.

Core Components of a Financial Digital Twin

1. Data Integration Layer

This layer connects data from:

-

Transaction systems

-

CRM platforms

-

Core banking systems

-

Trading desks and liquidity platforms

-

ERP tools

-

External market data providers like Bloomberg, Reuters, and S&P Global

It ensures clean, unified, and real-time data flows—essential for accurate modeling.

2. AI-Powered Modeling Engine

The modeling engine uses:

-

Machine learning

-

Predictive analytics

-

Monte Carlo simulations

-

Credit and market risk scoring algorithms

-

Stress-testing frameworks

These tools help run forecasts, simulate market shocks, and identify high-risk scenarios.

3. Visualization Toolset

Interactive dashboards allow analysts to:

-

Monitor risk exposure

-

Track customer behavior

-

Evaluate liquidity metrics

-

Review operational performance

This gives teams a clear, real-time view of financial health.

4. Closed-Loop Feedback System

A closed-loop mechanism updates the digital twin automatically when:

-

Market conditions change

-

Customer actions shift

-

Regulatory requirements are updated

-

Internal systems add new data

This keeps the digital twin fully aligned with real-world financial environments.

With these components working together, financial institutions can run simulations that are accurate, scalable, and closely matched to real-world outcomes—supporting stronger risk management, better decision-making, and improved operational resilience.

Why Financial Institutions Are Moving Toward Digital Twins?

The shift toward Digital Twin Technology in Finance is driven by the growing need for stronger resilience, faster insights, and smarter risk analytics across the financial sector.

Enhanced Risk Management

Banks, insurers, and fintech firms face many risks, including credit risk, market risk, liquidity risk, and operational risk. Traditional risk models often fail to capture sudden market shocks or non-linear events. A financial digital twin can:

-

Run real-time stress scenarios

-

Predict credit default risks

-

Detect liquidity pressures early

-

Simulate macroeconomic shocks

For example, a bank can model how an interest rate hike affects its mortgage book, deposits, and loan demand.

Advanced Customer Insights

Digital twins help financial institutions understand customer behavior—spending patterns, investment choices, loan habits, and digital channel usage. This allows organizations to:

-

Improve customer scoring

-

Personalize financial products

-

Predict customer churn

-

Increase customer lifetime value

Fintech innovators like Revolut, Nubank, and Monzo already use real-time behavioral analytics, making digital twin adoption a natural next step.

Stronger Regulatory Compliance

Regulators such as the Federal Reserve, European Central Bank (ECB), Financial Conduct Authority (FCA), and Bangladesh Bank require transparent, data-backed reporting. Digital twins help financial institutions comply with frameworks like:

-

Basel III / Basel IV

-

CECL

-

Solvency II

They offer audit-ready reports, real-time monitoring, and advanced simulation capabilities for regulatory stress testing.

Operational Efficiency

Financial digital twins analyze processes like loan approvals, onboarding, fraud detection, and payment workflows. They help identify:

-

Process bottlenecks

-

Manual errors

-

Fraud patterns

-

Inefficient resource allocation

This leads to better automation and lower operational risks across the organization.

Executive-Level Decision Support

CXOs and board members use digital twins to test scenarios before making major decisions. They can simulate:

-

New financial product launches

-

Pricing strategy changes

-

Market expansion plans

-

Capital and liquidity adjustments

This enables more confident, data-driven decision-making at the highest level.

Applications of Digital Twin Technology in Financial Risk Management

Digital Twin Technology is transforming enterprise-grade financial risk management by enabling real-time simulations, predictive analytics, and automated scenario modeling across all major risk categories. As banks, insurers, fintechs, and regulatory bodies push for more transparency and resilience, digital twins are becoming essential tools for credit risk assessment, market risk forecasting, liquidity management, fraud prevention, and cybersecurity readiness.

Credit Risk Modeling

Credit risk remains one of the most critical challenges for commercial banks, microfinance institutions, credit unions, and lending platforms. A financial digital twin can simulate:

-

Borrower repayment behavior

-

Portfolio sensitivity to macroeconomic variables

-

Probability of Default (PD)

-

Loss Given Default (LGD)

-

Exposure at Default (EAD)

-

Economic downturn and stress-test scenarios

Market Risk Management

Market volatility driven by global events, geopolitical tensions, currency swings, and interest rate movements requires constant monitoring. Digital twins allow risk teams and trading desks to simulate:

-

Equity market shocks

-

Foreign exchange (FX) rate fluctuations

-

Commodity price volatility

-

Bond yield curve shifts

-

VaR (Value at Risk) and CVaR calculations

This gives investment banks, asset managers, hedge funds, and wealth management firms a competitive edge in anticipating sudden disruptions.

Liquidity and Funding Risk

Liquidity risk is central to banking, payments, and insurance operations. Financial digital twins provide real-time visibility into:

-

Intraday liquidity flows

-

Maturity mismatches

-

Funding concentration risk

-

Cash reserve adequacy

-

High-frequency treasury operations

-

Contingency funding plans

This is crucial for digital banks, neobanks, and PSPs (Payment Service Providers) that rely on instant payments and 24/7 settlement cycles.

Operational and Fraud Risk

Operational risk in financial institutions covers everything from system failures to human errors and process inefficiencies. Digital twins can simulate:

-

Workflow breakdowns

-

Staff shortages

-

Core banking outages

-

Payment processing delays

-

ATM network failures

-

Customer onboarding bottlenecks

Fraud risk models identify anomalies such as:

-

Suspicious transactions

-

Synthetic identity fraud

-

Card-not-present (CNP) fraud

-

Account takeover attempts

-

Money laundering patterns (AML)

Cybersecurity Risk

Cyber threats are accelerating across the financial sector, especially with increased cloud adoption. Digital twins of IT and cybersecurity infrastructures help institutions:

-

Simulate cyberattacks (DDoS, ransomware, phishing)

-

Test new security controls

-

Assess vulnerabilities across networks

-

Strengthen incident response strategies

-

Validate SOC (Security Operations Center) readiness

These capabilities are essential for banks and fintechs running hybrid architectures across public clouds.

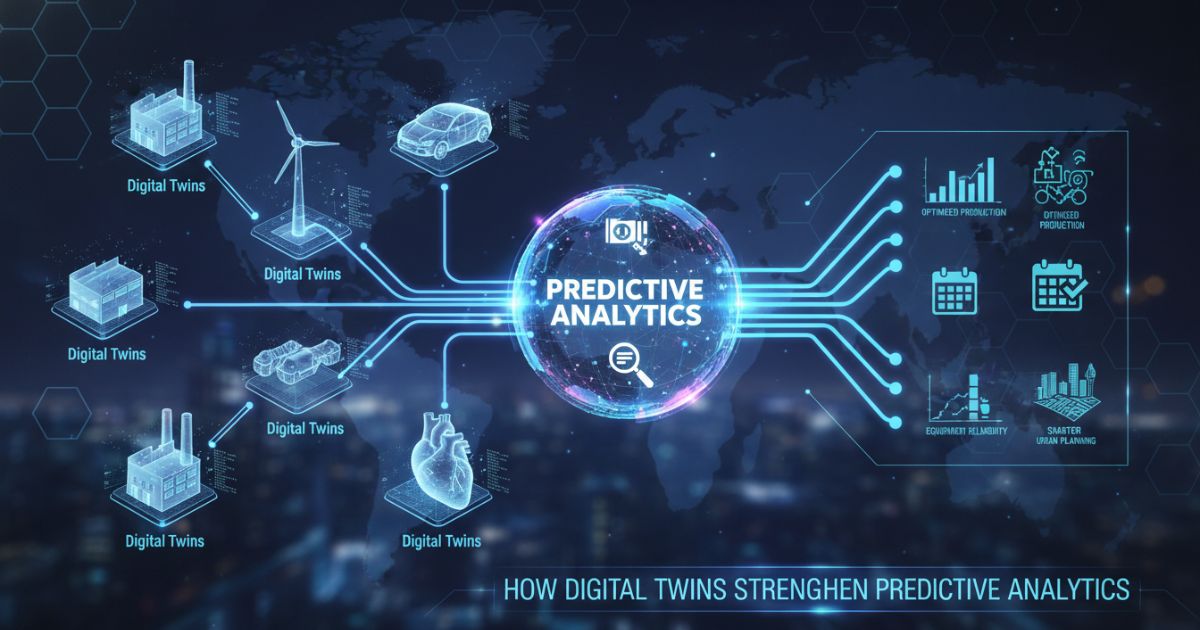

How Digital Twins Strengthen Predictive Analytics?

Digital Twin Technology supercharges predictive analytics in finance by combining real-time data streams, machine learning models, and scenario simulations. This allows banks, fintechs, insurers, wealth managers, and payment providers to predict future outcomes with far greater accuracy than traditional forecasting tools. By synchronizing customer, portfolio, and operational data, digital twins create a dynamic environment for continuous forecasting, optimization, and decision-making.

Customer Lifetime Value (CLV) Forecasting

With customer digital twins, financial institutions can build highly granular models of user behavior and economic outcomes. This helps predict:

-

Retention probability

-

Cross-sell / upsell opportunities

-

Loan growth potential

-

Investment behavior and risk appetite

-

Churn likelihood

-

Customer lifetime value (CLV)

These insights power next-generation personalization engines, enabling more targeted offers, product recommendations, and customer engagement strategies.

Revenue and Profitability Forecasting

Digital twins help executive teams test how changes in internal and external conditions affect revenue streams. Institutions can simulate:

-

Interest rate fluctuations

-

Market volatility

-

Corporate and retail loan demand

-

Deposit movements

-

Investment flows and fund performance

-

Fee-based revenue shifts

This enables CFOs, CROs, and strategy teams to predict net interest income (NII), P&L impacts, and capital optimization opportunities more accurately.

Portfolio Optimization

For asset managers and wealth management platforms, digital twins make portfolio optimization more dynamic, personalized, and data-driven. Institutions can use them to:

-

Rebalance portfolios in real time

-

Backtest and stress-test trading strategies

-

Optimize risk-adjusted returns

-

Model correlations and diversification benefits

-

Simulate long-term investment scenarios

This technology is especially valuable for robo-advisors, which automate decision-making using AI and algorithmic engines.

Challenges of Implementing Digital Twin Technology in Finance

As powerful as Digital Twin Technology is, its adoption across banking, insurance, fintech, and capital markets comes with several operational, technical, and regulatory challenges. Financial institutions must overcome data complexity, cost barriers, cybersecurity risks, and organizational resistance to fully unlock the value of real-time simulation and predictive analytics.

Data Quality and Integration Issues

High-performing financial digital twins rely on clean, consistent, and integrated data pipelines. However, many institutions struggle with:

-

Legacy systems and outdated core banking platforms

-

Siloed databases across risk, credit, treasury, compliance, and operations

-

Inconsistent data formats and missing metadata

-

Fragmented third-party datasets (e.g., Bloomberg, Reuters, Moody’s Analytics)

-

Low-quality historical data affecting ML model accuracy

Building a digital twin requires unifying structured and unstructured data from CRM systems, trading engines, payment networks, ERP systems, and market data feeds.

High Initial Costs

Launching a full-scale digital twin involves significant upfront investment in:

-

AI/ML infrastructure (modeling engines, GPU/TPU compute)

-

Cloud computing platforms (AWS, Azure, Google Cloud, Oracle Cloud)

-

Data engineering and DevOps teams

-

Cybersecurity architecture and threat-monitoring tools

-

Model validation and risk governance frameworks

While initial CapEx can be substantial, long-term benefits—such as lower operational risk, automation gains, and more accurate forecasting—often outweigh the costs.

Security and Privacy Concerns

Financial digital twins handle highly sensitive data, making robust protection critical. Institutions must safeguard data using:

-

End-to-end encryption

-

Zero-trust security frameworks

-

Multi-factor and identity access management (IAM)

-

Secure API gateways

-

Real-time threat detection and anomaly monitoring

-

Compliance with GDPR, CCPA, PSD2, and local regulatory requirements

Cyber threats—including data breaches, spoofing, and AI model manipulation—pose major risks, especially for banks using multi-cloud or hybrid cloud setups.

Organizational Change and Workforce Readiness

Digital twin adoption requires a major cultural and operational shift across the organization. Financial institutions must prepare for:

-

Staff reskilling and training in AI, analytics, and digital operations

-

Revised workflows and decision-making processes

-

Cross-department collaboration (risk, IT, operations, finance, compliance)

-

New AI governance frameworks ensuring transparency, explainability, and auditability

-

Resistance to change, especially in highly regulated banking environments

The Future of Digital Twin Technology in Finance

The future of Digital Twin Technology in Finance is heading toward deeper intelligence, full automation, and hyper-personalized financial ecosystems. As financial institutions accelerate digital transformation and expand their use of AI, cloud computing, IoT data streams, and advanced analytics, the next generation of digital twins will reshape how banks, insurers, and fintech companies approach risk, operations, and customer engagement.

Autonomous Decision Engines

The next evolution of financial digital twins will include autonomous decision engines capable of making real-time, data-driven decisions across core financial functions. These engines will leverage machine learning, reinforcement learning, and predictive intelligence to automate:

-

Portfolio management and rebalancing

-

AI-powered loan underwriting

-

Real-time fraud alerts

-

Dynamic credit scoring models

-

Automated treasury and liquidity decisions

Banks and investment firms like BlackRock, JPMorgan Chase, and Goldman Sachs are already experimenting with autonomous finance systems—digital twins will accelerate this transformation.

Real-Time Market Digital Twins

In the coming years, entire financial markets may be replicated as digital twins in real time, integrating:

-

Stock price movements

-

FX rate fluctuations

-

Bond yield changes

-

Commodity shocks

-

Macro indicators (GDP, CPI, interest rates)

These large-scale market simulations will support scenario testing, stress forecasting, and volatility modeling for central banks, hedge funds, and regulatory bodies such as the Federal Reserve, ECB, FCA, and MAS.

Customer-Specific Financial Twins

Over time, every customer may have a personalized digital twin that continuously analyzes financial behavior and optimizes:

-

Credit limits and loan offers

-

Insurance pricing and risk scoring

-

Wealth planning strategies

-

Savings goals and investment allocations

-

Overall financial health monitoring

Retail banks and digital-first fintech platforms—such as Revolut, Nubank, Monzo, and Chime—are already moving toward hyper-personalization, making customer-level digital twins a natural next step.

Integration With Generative AI

The fusion of Generative AI and digital twins will unlock new capabilities in financial modeling, including:

-

Synthetic data generation to improve model training

-

Predictive narratives explaining market events or customer behaviors

-

Automated recommendations for risk mitigation, portfolio optimization, or customer engagement

-

Faster scenario creation, reducing model development cycles from months to minutes

Generative models from platforms like OpenAI, Google Gemini, and AWS Bedrock will enhance accuracy, scalability, and interpretability across financial simulations.

Conclusion

Digital Twin Technology in Finance is revolutionizing how banks, insurers, fintech startups, and investment firms manage risk, optimize operations, and enhance performance. By creating dynamic virtual replicas of portfolios, customers, and financial systems, digital twins deliver real-time insights, run complex scenario simulations, and support data-driven decision-making across all major risk domains—including credit risk, market risk, liquidity risk, operational risk, fraud detection, and cybersecurity.

As global financial ecosystems become more volatile and interconnected, adopting a financial digital twin strategy will be essential for regulatory compliance, risk resilience, and intelligent automation. Institutions that embrace digital twins early—whether traditional banks like HSBC, Citi, and Deutsche Bank, or digital-first innovators like Revolut, N26, and Monzo—will gain a significant competitive edge through faster insights, stronger risk profiles, and hyper-personalized customer experiences.

The future of AI-driven finance will be built on digital twins integrated with Generative AI, real-time market data, and predictive analytics, enabling organizations to operate with greater accuracy, transparency, and agility.

Financial leaders who invest now will shape the next era of resilient, intelligent, and customer-centric financial services.

FAQs

1. What is Digital Twin Technology in Finance?

It is a virtual model of a financial process, system, or customer profile used to simulate outcomes and improve risk management.

2. How do digital twins improve financial risk management?

They simulate thousands of credit, liquidity, market, and operational scenarios, helping institutions prepare for real-world uncertainties.

3. Which financial sectors benefit the most from digital twins?

Banking, insurance, fintech, asset management, and regulatory bodies benefit significantly from digital twin in finance.

4. Are digital twins expensive to adopt?

While initial costs can be high, the long-term value in risk reduction, automation, and forecasting often delivers strong ROI.

5. Can digital twins improve customer experience?

Yes. They help personalize financial products, improve risk-based pricing, and enhance customer journey analysis.

Embedded Finance and the Future of Seamless Digital Financial Services

How AI-Based Fraud Detection is Protecting Digital Payments

Harnessing AI and Machine Learning for Fraud Detection in Digital Finance

Digital Marketing for Financial Services: Strategies That Deliver Results

Digital Twin Technology in Finance: How Virtual Models Are Transforming Risk Management

The Future of Personal Finance: Autonomous Finance and AI Money Management

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

AI Fraud Detection: How Banks Prevent Financial Crime in Real Time