The Fintech Industry is transforming how we manage money by merging technology and finance. From mobile payments, digital wallets, and lending platforms to blockchain, robo-advisors, insurtech, and regtech, fintech is making financial services more accessible, efficient, and global. Innovations like AI, automation, and decentralized finance (DeFi) are reshaping traditional banking, creating opportunities for startups, investors, and consumers alike. Despite challenges such as regulatory hurdles, cybersecurity threats, and customer adoption issues, the future-of-finance is digital, interconnected, and highly innovative.

The way we deal with money has evolved. With the advent of mobile apps for banking to crypto financial technology, also known as “fintech,” is reshaping the financial world in its traditional form. What exactly is fintech as well as why it is crucial?

If you’re a budding businessperson aiming to create the next major startup, a fan of fintech looking for industry trends, or a tech innovator pursuing the latest advancements in automation, this guide will provide you with an in-depth understanding of the fintech sector and its incredible potential.

What is Fintech? An Overview

Fintech, short for “financial technology,” refers to the innovative use of technology to enhance, streamline, and transform financial services. At its core, fintech is about applying digital solutions to improve the way we manage, invest, transfer, and track money. This can range from simple apps that help users monitor their spending and savings to complex blockchain-based systems that enable decentralized financial transactions.

Fintech is not just about technology—it’s about rethinking traditional financial services with creativity and efficiency. By merging the worlds of finance and technology, fintech solves problems that were once slow, costly, or inaccessible. It empowers individuals, businesses, and institutions to interact with money in ways that are faster, more secure, and often more affordable than traditional banking methods.

Examples of fintech in everyday life are abundant. If you’ve ever used Venmo or Cash App to split a bill with friends, invested in stocks through Robinhood, or made a coffee purchase via Apple Pay or Google Pay, you’ve directly engaged with the fintech industry. Behind these seamless experiences are technologies that automate transactions, secure data, detect fraud, and provide users with insights to make smarter financial decisions.

Beyond convenience, fintech also plays a key role in financial inclusion, giving unbanked or underserved populations access to banking, credit, and investment opportunities that were previously out of reach. In essence, fintech is reshaping the global financial landscape—making money management more efficient, personalized, and accessible for everyone.

Why the Fintech Industry is Transforming Finance

The fintech industry is reshaping the financial world by combining technology with banking, investment, lending, and insurance services. By leveraging AI, automation, and digital platforms, fintech companies are making financial services faster, more accessible, and more customer-centric.

This transformation not only benefits consumers but also creates opportunities for startups, investors, and traditional financial institutions to innovate. With global connectivity, fintech enables seamless cross-border payments, real-time tracking, and smarter financial decisions.

Key reasons fintech is critical today:

-

Increased financial inclusion for underbanked populations

-

Faster, more efficient transactions and services

-

Innovative solutions through AI, blockchain, and automation

Why is Fintech Important?

Fintech has thrown off the traditional banking system, and has made vital services such as lending, banking, insurance, and investment easier to access, faster, and usually more affordable. This is why it’s important:

- Financial inclusion: Fintech provides access to financial services to those who aren’t served. Mobile money platforms such as M-Pesa have revolutionized the way people in developing nations save, transfer, and spend money.

- innovation at scale Automating and Artificial Intelligence have simplified processes like loans as well as fraud detection and financial planning that is personalized.

- Global reach The traditional financial systems typically require expensive intermediaries. Fintech platforms enable global transactions for only a fraction of the cost, and can help boost global commerce and trade.

Key Areas of the Fintech Industry

Fintech isn’t one thing. It’s a broad ecosystem that offers unique solutions that are able to be applied in a variety of fields. Here are a few of the most popular sectors that are generating growth in fintech currently.

1. Mobile Payments and Digital Wallets

Mobile applications like PayPal, Google Pay, and Apple Pay have changed the way people pay for goods or services. These apps make it unnecessary to use physical cash, or credit cards, which makes transactions quicker and safer.

For instance, Venmo integrates payment capabilities with social functions, turning what is essentially repaying a friend into a seamless, enjoyable experience.

2. Lending Platforms

The traditional loan application process is known for their time-consuming and bureaucratic nature. Fintech companies have streamlined the process by introducing peer-to-peer lending platforms such as LendingClub and AI-driven tools for assessing credit risk.

These advancements allow consumers to obtain loans quickly, usually with greater transparency and competitive interest rates.

3. Blockchain and Cryptocurrency

When people think of fintech, they usually imagine Bitcoin. Blockchain technology, which is the foundation of cryptocurrency, has created new avenues to secure payments, decentralized financial (DeFi) as well as tokenization of assets.

Platforms such as Ethereum, for instance, allow developers to develop apps that are decentralized (dApps), which can create entirely different business models.

4. Robo-Advisors and Wealth Management

Tools such as Betterment and Wealthfront offer advanced advice on investing as well as portfolio management and retirement planning solutions for less than the fees that traditional financial advisors charge.

Utilizing algorithms instead of human advisors, these robots offer information-driven strategies that make the management of wealth for all different income levels.

5. Insurtech

Insurance companies are upping their game by implementing insurtech solutions. These innovative solutions use AI along with big data to design custom policies, identify risks better, and reduce claims process time.

For instance, companies such as Lemonade have revolutionized the insurance market with speedy mobile access to homeowners’ and renters’ insurance.

6. Regtech (Regulatory Technology)

Compliance with regulations is among the most challenging aspects of the financial sector. Regtech companies are experts in constructing software solutions to help companies meet the requirements of regulatory compliance effectively.

Popular regtech tools such as ComplyAdvantage and Onfido detect risks, fight fraud, and streamline the process of ensuring compliance for financial institutions.

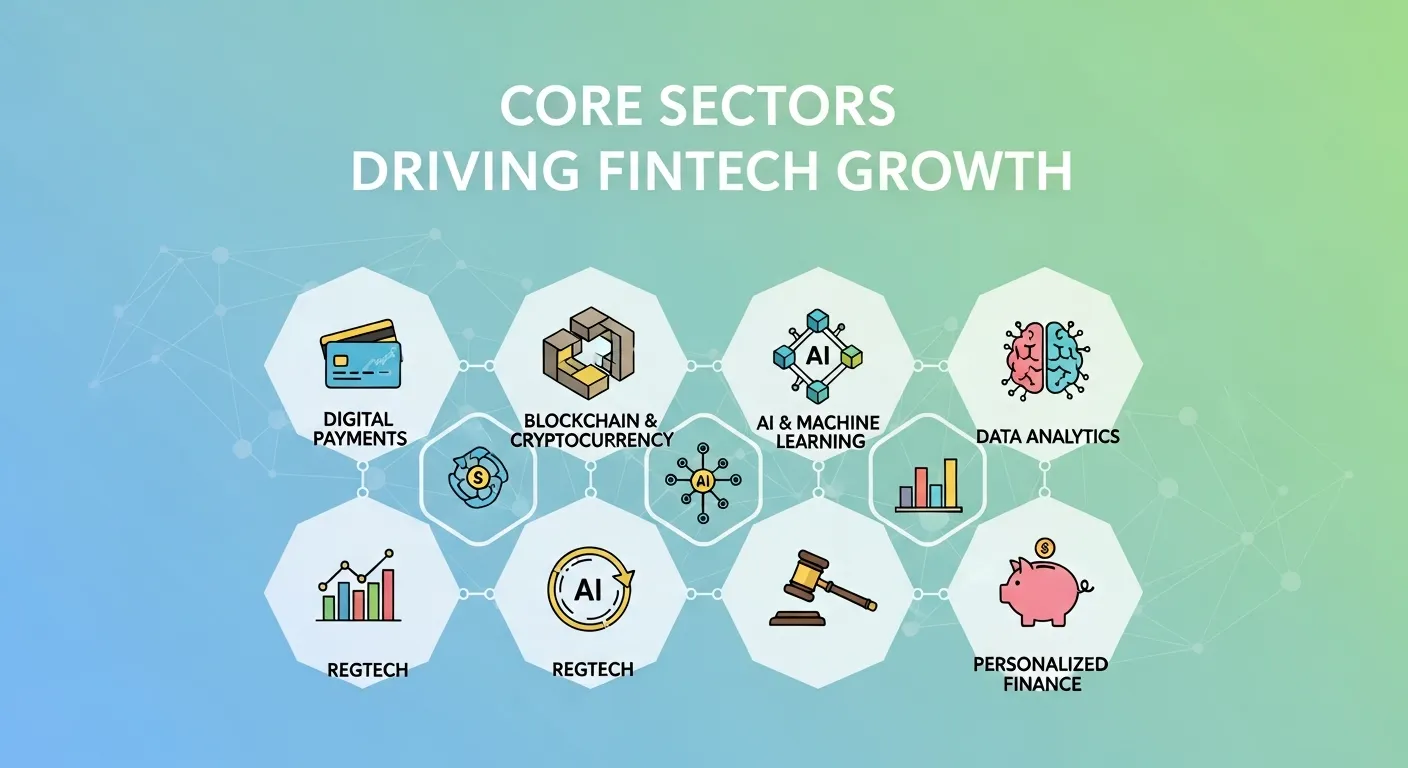

Core Sectors Driving Fintech Growth

The fintech industry is a diverse ecosystem encompassing various sectors, each offering unique solutions. From digital wallets to insurtech, these innovations simplify finance and expand access globally.

Companies in fintech continuously develop new tools, such as mobile payment apps, lending platforms, robo-advisors, and blockchain networks, to enhance user experience and create efficiency.

Prominent fintech sectors include:

-

Mobile payments and digital wallets

-

Lending and peer-to-peer platforms

-

Blockchain and cryptocurrency

-

Robo-advisors and wealth management

-

Insurtech

-

Regtech

| Sector | Example | Key Benefit |

|---|---|---|

| Mobile Payments | PayPal, Apple Pay | Faster, cashless transactions |

| Lending Platforms | LendingClub | Quick access to loans |

| Blockchain & DeFi | Ethereum | Secure, decentralized transactions |

| Robo-Advisors | Betterment, Wealthfront | Cost-effective investment management |

| Insurtech | Lemonade | AI-driven insurance solutions |

| Regtech | Onfido, ComplyAdvantage | Compliance automation |

Challenges Facing the Fintech Industry

Although fintech is transforming finance, it has its own challenges. For innovators and entrepreneurs these challenges also provide opportunities to fill the gaps that are critical.

1. Regulatory Hurdles

It can be a daunting task for startups in fintech. Each country has its own unique laws that govern areas like security, data privacy, and other areas. However, staying compliant is essential to establish trust with the users.

2. Cybersecurity Threats

With sensitive financial information at the core of fintech solutions, startups are constantly under attack from scammers and hackers. Secure security, encryption, and multi-factor authentication, and safe protocols are essential for businesses in fintech.

3. Customer Adoption

Despite their advantages, however, fintech solutions often face resistance, particularly among older people or those who are skeptical of the new technology. The companies must work on educating their customers and making their onboarding easier to earn confidence.

Overcoming Obstacles in the Fintech Industry

Despite its rapid growth, the fintech industry faces significant challenges that can slow adoption and create risks. Regulatory hurdles, cybersecurity threats, and customer skepticism are among the most pressing concerns for startups and established firms alike.

To succeed, fintech companies must implement robust security measures, adhere to local and global regulations, and educate customers about the benefits of digital financial services. Proactive strategies help build trust and ensure long-term viability.

Top challenges include:

-

Compliance with international and regional financial regulations

-

Protecting sensitive financial data against cyber threats

-

Encouraging customer adoption and trust

What’s Next for the Fintech Industry?

The fintech sector is predicted to expand at a rapid rate. The most important trends are the increased adoption of AI as well as the development of DeFi systems, as well as a greater co-operation between startups in fintech as well as traditional banks.

If you’re a budding entrepreneur, now is the opportunity to look into possibilities in Fintech. It doesn’t matter if you’re creating an app on mobile devices to improve understanding of finances or constructing the first blockchain-powered payment system there’s a lot of room for innovation on every scale.

The Future of Finance: Opportunities and Trends

The future-of-finance is digital, interconnected, and highly innovative. Fintech trends such as AI-driven predictive analytics, decentralized finance (DeFi), automated workflows, and collaboration with traditional banks are reshaping the industry.

Entrepreneurs and innovators have enormous opportunities to create solutions that simplify payments, lending, insurance, investment, and wealth management while enhancing accessibility and reducing costs for consumers globally.

Future trends shaping finance:

-

Widespread adoption of AI and automation

-

Growth of decentralized finance (DeFi) platforms

-

Increased partnership between fintech startups and traditional banks

-

Global reach and financial inclusion through digital tools

Closing Thoughts

The fintech sector is an important shift in the way we view and interact with money. It’s not only creating what the future will look like for finance, it’s changing the way we live, communicate and create.

If you’re looking to take part in the revolution in fintech, begin looking into trends and tools now. You never know. Your ideas could turn out to be the next idea to shake up this booming sector.

Frequently Asked Questions – Fintech Industry & Future of Finance

1. What is the Fintech Industry?

The Fintech Industry combines finance and technology to create innovative solutions that enhance banking, payments, lending, investing, insurance, and other financial services. It focuses on efficiency, accessibility, and customer-centric experiences.

2. What does future-of-finance mean?

The future-of-finance refers to the ongoing digital transformation of financial services. It involves integrating advanced technologies to make financial operations faster, more transparent, more secure, and more innovative for consumers and businesses alike.

3. What are the main sectors of the Fintech Industry?

The Fintech Industry spans multiple sectors, including:

-

Mobile payments and digital wallets (e.g., PayPal, Apple Pay)

-

Lending platforms (peer-to-peer loans, AI-based credit assessment)

-

Blockchain and cryptocurrency (Bitcoin, Ethereum, DeFi)

-

Robo-advisors and wealth management (Betterment, Wealthfront)

-

Insurtech (AI-driven insurance solutions like Lemonade)

-

Regtech (regulatory compliance solutions like Onfido and ComplyAdvantage)

4. How does fintech improve financial inclusion?

Fintech expands access to banking and financial services for underbanked populations. Mobile money platforms like M-Pesa allow people in developing regions to save, transfer, and manage money without traditional banks.

5. What role does blockchain play in the Fintech Industry?

Blockchain provides secure, transparent, and decentralized financial transactions. It supports cryptocurrencies, tokenized assets, and decentralized finance (DeFi) platforms, reducing reliance on traditional intermediaries.

6. How are AI and automation used in fintech?

AI and automation streamline financial services by enabling predictive financial planning, fraud detection, credit scoring, risk analysis, and robo-advisory services. This reduces errors, saves time, and improves customer experiences.

7. What challenges does the Fintech Industry face?

Key challenges include:

-

Regulatory compliance across different countries

-

Cybersecurity threats targeting sensitive financial data

-

Customer adoption and trust, particularly among older users or those skeptical of new technologies

8. How is mobile banking changing finance?

Mobile banking and digital wallets enable instant payments, peer-to-peer transfers, and real-time financial tracking. They reduce dependence on cash and cards while improving convenience for users globally.

9. Can fintech benefit traditional banks?

Yes. Fintech partnerships help banks modernize digital services, improve efficiency, enhance customer experiences, and expand their reach without developing all technology in-house.

10. What is the role of insurtech in the Fintech Industry?

Insurtech uses AI, big data, and digital platforms to improve insurance offerings, speed up claims processing, personalize policies, and reduce operational costs for insurers and customers.

11. What trends are shaping the future-of-finance?

Key trends include AI adoption, blockchain and decentralized finance (DeFi), digital payments, automation of financial workflows, and increased collaboration between fintech startups and traditional banks.

12. Why should businesses and entrepreneurs focus on fintech?

The Fintech Industry offers opportunities for innovation, global market expansion, cost efficiency, and creating new ways for customers to access and manage financial services. Engaging in fintech allows businesses to stay competitive and shape the future-of-finance.

How AI-Based Fraud Detection is Protecting Digital Payments

Embedded Finance and the Future of Seamless Digital Financial Services

Harnessing AI and Machine Learning for Fraud Detection in Digital Finance

Embedded Finance: How Seamless Financial Services Are Integrating into Everyday Apps

Digital Twin Technology in Finance: How Virtual Models Are Transforming Risk Management

The Future of Personal Finance: Autonomous Finance and AI Money Management

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

AI Fraud Detection: How Banks Prevent Financial Crime in Real Time