Digital transformation has made a deep impact on the financial sector. Among the many innovations, Digital Process Automation (DPA) has emerged as a vital force. But what is digital process automation in financial services, really?

It’s more than just software. It’s a strategy that helps banks, insurance companies, and other financial institutions streamline their operations using digital tools. Let’s break it down.

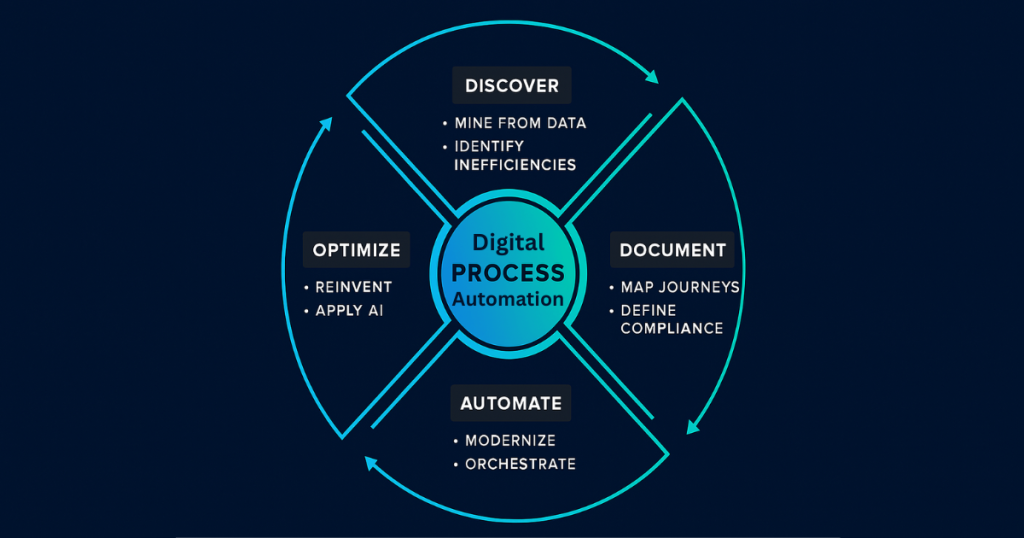

What is Digital Process Automation?

Digital Process Automation (DPA) refers to using modern technology to automate complex, multistep business processes. Unlike simple task automation, DPA handles end-to-end workflows.

Think of it as a way to eliminate manual paperwork, reduce delays, and ensure consistent performance across departments. Digital automation often plays a key role in expanding what financial and digital inclusion can achieve.

DPA is not a tool but a system powered by technologies like:

-

Artificial intelligence (AI)

-

Machine learning (ML)

-

Robotic Process Automation (RPA)

-

Business Process Management (BPM)

-

Low-code and no-code platforms

In financial services, it’s used to handle everything from loan approvals to fraud detection, with speed and accuracy.

Why Financial Services Need DPA

The financial world is known for its complex operations, strict regulations, and need for precision. Traditional systems often rely on legacy software and manual inputs, which slow things down.

This is where DPA steps in.

By automating workflows, banks and financial institutions can:

-

Improve accuracy

-

Reduce processing time

-

Cut operational costs

-

Ensure regulatory compliance

-

Deliver faster customer service

In an industry where seconds matter, automation is no longer optional—it’s necessary.

Common Use Cases in Finance

Loan Processing

Traditionally, loan approvals involve multiple forms, manual credit checks, and long wait times. DPA automates these steps by integrating data from multiple systems, checking eligibility, and even sending approval emails—all within minutes.

KYC and Compliance

Know Your Customer (KYC) processes are tedious but essential. With DPA, these can be streamlined. Data from various sources can be collected, verified, and stored with full audit trails, reducing human error.

Fraud Detection

By integrating real-time data analysis, DPA systems can flag unusual transactions. These alerts help financial institutions take quick action, protecting both the customer and the business.

Account Opening

Digital onboarding, including document uploads and identity verification, can be automated. What once took days now takes hours—or even minutes.

Key Benefits of Digital Process Automation

1. Enhanced Customer Experience

Today’s customers expect speed and convenience. DPA helps deliver both. Whether it’s approving a credit card or resolving a support issue, automation ensures faster, smoother service.

2. Operational Efficiency

Employees no longer have to juggle spreadsheets and paperwork. Automated processes reduce manual work, freeing staff for higher-level tasks like customer relationship management or strategic planning.

3. Better Compliance

The financial sector is heavily regulated. DPA tools can ensure that every action taken is recorded, auditable, and compliant with laws like GDPR, AML, and more.

4. Scalable Processes

As your business grows, manual systems struggle to keep up. DPA can scale effortlessly. Whether it’s 100 or 10,000 applications, the process remains stable and reliable.

How DPA Differs from RPA and BPM

It’s easy to confuse Digital Process Automation with Robotic Process Automation (RPA) or Business Process Management (BPM). Let’s clear that up.

-

RPA automates individual tasks, like extracting data from emails.

-

BPM is more about managing and optimizing existing processes.

-

DPA combines both—automating whole workflows from start to finish.

In simple terms, if RPA is a robot doing one task, DPA is the system controlling multiple robots across an entire business line.

Technology Behind DPA in Financial Services

Several technologies work together in DPA platforms:

-

AI and ML for decision-making and pattern recognition

-

APIs to integrate multiple systems

-

Cloud platforms for scalability and accessibility

-

Low-code tools to design processes with minimal programming

These technologies ensure that even legacy banking systems can connect with modern digital tools, allowing for full digital transformation.

Challenges to Consider

Despite its benefits, implementing DPA isn’t plug-and-play. Financial institutions must:

-

Ensure data security

-

Train employees to work with new systems

-

Re-architect legacy systems for compatibility

-

Monitor performance continuously

However, with the right planning and tools, these hurdles are manageable.

Real-World Example

Let’s take the case of a mid-sized bank implementing DPA for credit card applications.

Before automation, the process took 7–10 days. After DPA, the same process took less than 24 hours. Manual verification was replaced by real-time checks using APIs connected to credit bureaus. Approval emails and card activation were automated. Customer satisfaction scores improved within weeks.

This is the power of digital process automation in action.

Future of Digital Automation in Finance

As artificial intelligence becomes more advanced, DPA will evolve too. Predictive analytics, conversational AI, and blockchain are already being integrated into automation platforms.

We may soon see a future where financial services run on mostly autonomous systems—guided by human strategy, but executed by intelligent software.

That future isn’t decades away. It’s happening now.

Conclusion

So, what is digital process automation in financial services?

It’s the modern backbone of efficiency. By automating complex workflows, DPA helps financial organizations become faster, smarter, and more customer-focused.

From loan processing to compliance, digital automation reduces delays, errors, and costs—allowing teams to focus on what matters most: delivering value.

As the financial industry continues to evolve, DPA isn’t just a trend. It’s a competitive necessity.

Google Pay in Bangladesh: Expediting Fintech and Digital Inclusion

What Is Financial Technology (FinTech)? Everything You Need to Know

How Open Banking APIs Are Revolutionizing Digital Finance?

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

Digital Twin Technology in Finance: How Virtual Models Are Transforming Risk Management

The Future of Personal Finance: Autonomous Finance and AI Money Management

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

AI Fraud Detection: How Banks Prevent Financial Crime in Real Time