Tokenized assets are changing trading by converting real-world and digital assets into blockchain tokens, enabling fractional ownership, global access, transparency, faster settlement, and security, while lowering investment barriers and creating a more inclusive ecosystem despite regulatory, technical, and market risks.

The financial world is changing fast. Technology is transforming how we think about ownership, trading, and investing. One of the biggest changes is the rise of tokenized assets. These are digital representations of real-world or digital assets that can be bought, sold, and traded online. They are opening up new opportunities for both retail investors and institutional players.

Tokenized assets make it possible to own a small piece of things like real estate, stocks, art, or commodities. This concept, called fractional ownership, allows more people to invest in high-value assets that were once out of reach. At the same time, blockchain technology ensures that these investments are secure, transparent, and easy to trade.

What Are Tokenized Assets?

Tokenized assets are digital versions of real-world or digital assets that exist on a blockchain. You can think of them as digital certificates of ownership. Just like owning a stock or a piece of property, owning a token gives you rights to part of an asset—but in a fully digital form. These tokens can be bought, sold, and traded online, making investing easier and more flexible.

The process of tokenization transforms the ownership rights of an asset into a digital token. Most of these tokens are created on Ethereum or other blockchain platforms like Polygon, Solana, or Binance Smart Chain. This ensures that tokens are secure, transparent, and easy to transfer. Every transaction is recorded on the blockchain, so ownership and trade history are fully visible and cannot be tampered with.

Some Kinds of Assets Which Can Be Tokenized

Almost any asset can be tokenized and turned into a digital investment on a blockchain platform. Tokenization allows investors to own a fraction of high-value assets that were previously difficult to access. Here are some common examples:

-

Real Estate Properties: Investors can buy tokens representing a share of a rental home, apartment building, or commercial property. This allows participation in the real estate market without needing to purchase an entire property.

-

Stocks and Bonds: Traditional securities can be tokenized, letting investors trade shares or bonds digitally 24/7. This provides faster settlement and easier access to global markets.

-

Commodities: Assets like gold, silver, and oil can be tokenized. Investors can own a portion of the commodity without physically storing or transporting it.

-

Art and Collectibles: High-value artwork, rare collectibles, or luxury items can be fractionalized. Platforms like Masterworks let multiple investors co-own a piece of art, opening up the “blue-chip” art market to more people.

-

Intellectual Property: Patents, trademarks, and copyrights can be tokenized, allowing investors to benefit from royalties or licensing revenue.

-

Company Shares: Private companies can issue tokens representing equity shares, giving investors access to startups or private enterprises.

-

Investment Funds: Mutual funds, hedge funds, and private equity funds can be tokenized, providing digital access to institutional-level investments.

Each token corresponds to a specific percentage or portion of the underlying asset. This fractional ownership lowers the entry barrier, making it possible for more investors to diversify their portfolios and access premium assets without large capital outlays.

Tokenized assets create a more inclusive, global, and flexible investment landscape, allowing anyone with an internet connection to participate in markets that were once exclusive.

How Digitally Traded Tokenized Assets Work

Blockchain technology makes it simple to buy, sell, and trade tokenized assets on digital platforms. Unlike traditional markets, these platforms operate 24/7 and allow investors from anywhere in the world to participate.

Trading tokenized assets involves several key steps:

Tokenization of the Asset

The first step is to convert a real-world asset, like a property, stock, or artwork, into a digital token on a blockchain. This token represents ownership or a share of the asset.

Listing on a Trading Platform

Once tokenized, the asset is listed on a digital trading platform or marketplace. Investors can view details about the asset, check its ownership history, and see available tokens for sale.

Smart Contracts for Automation

The Future of Budgeting in the Age of Smart Contracts are self-executing programs on the blockchain. They automatically handle transactions, like transferring ownership or distributing income from the asset (e.g., rent from a tokenized property). This reduces the need for middlemen and ensures secure, transparent trading.

Buying, Selling, and Trading Tokens

Investors can purchase tokens with fiat currency or crypto assets. Once you own tokens, you can sell them on the platform, trade them for other tokens, or hold them as part of your digital investment portfolio.

Fractional Ownership and Portfolio Flexibility

Each token usually represents a fractional share of the underlying asset, allowing investors to diversify across multiple asset types. This makes it easier to manage a balanced and flexible investment portfolio.

By combining blockchain technology, smart contracts, and digital trading platforms, tokenized assets create a more accessible, efficient, and transparent way to invest in both traditional and alternative assets.

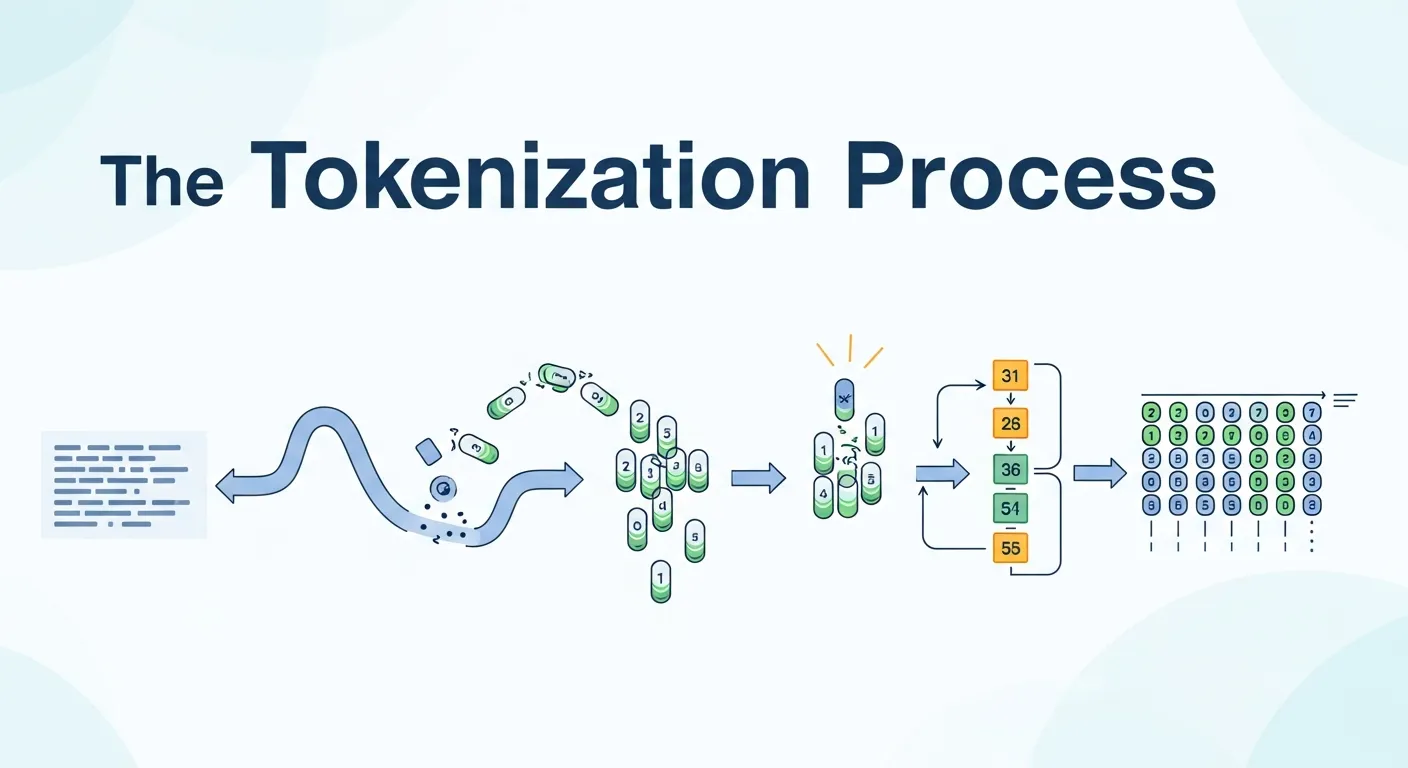

The Tokenization Process

Creating tokenized assets follows a structured process to ensure security, transparency, and regulatory compliance. Here’s how it works step by step:

Asset Appraisal

The first step is a thorough assessment and evaluation of the underlying asset by experts. Whether it’s real estate, art, or a financial security, this ensures the asset’s value is clear and reliable for potential investors.

Legal and Regulatory Framework

A strong legal framework is essential before creating tokens. This includes complying with securities laws, tax regulations, and investor protection rules. Proper legal structures give investors confidence that their rights are secure.

Token Creation

After the legal groundwork is set, the asset is converted into digital tokens using blockchain technology. Each token represents a specific share or fraction of the asset, allowing for fractional ownership. Platforms like Ethereum, Solana, and Polygon are commonly used to issue these tokens.

Token Distribution

Once created, the tokens are offered to investors through digital trading platforms or exchanges. Investors can purchase these tokens directly and become part-owners of the underlying asset.

Secondary Market Trading

After the initial sale, tokens can be bought, sold, and traded on secondary markets. This provides liquidity, allowing investors to enter or exit positions more easily than in traditional asset markets.

By following this process, tokenized assets combine the security of blockchain, the legitimacy of legal frameworks, and the flexibility of digital trading, making them a modern, accessible way to invest.

Smart Contracts and Automation

Smart contracts are a key part of trading tokenized assets. They are self-executing programs on the blockchain that automatically carry out transactions when certain conditions are met. This reduces the need for middlemen, saves time, and ensures secure and transparent processing.

For example, imagine you own tokens representing a rental property. A smart contract can automatically distribute rental income to all token holders on a set schedule. You don’t need a property manager or a bank to process the payments—everything happens automatically and is recorded on the blockchain.

Smart contracts can also handle other transactions, such as:

-

Automatically transferring ownership when tokens are sold

-

Releasing funds to investors after a tokenized investment reaches a milestone

-

Enforcing rules for participation in digital investment funds

This automation not only reduces costs but also increases trust and efficiency. Investors can see exactly how and when transactions are executed, making tokenized asset trading more reliable and user-friendly.

Advantages of Tokenized Assets in Trading

Tokenized assets have many benefits which have attracted investors and institutions from around the globe.

Increased Liquidity

Real estate or fine art can be harder to sell; it can take months or years. Because tokenized assets are traded 24/7 on digital platforms, the liquidity is very high.

This greater liquidity allows investors to:

-

Exit positions more quickly

-

Adjust portfolios in real-time

-

Access funds when needed

-

Take advantage of market opportunities

Lower Investment Barriers

Tokenization provides for fractional ownership, so investors can buy a piece of expensive assets. So long as you buy tokens that represent a small slice of a commercial property, however, you’re in.

The “democratizing” nature of many of these opportunities translates to:

-

Smaller minimum investments

-

Greater portfolio diversification

-

Access to premium assets

-

Reduced concentration risk

Global Market Access

Tokenized/ digitized assets This category eliminates geographical asset investment barriers. An investor in Tokyo can buy tokens linked to New York real estate or ownership stakes in European art collections.

Benefits include:

-

Worldwide investment opportunities

-

Currency flexibility

-

Reduced transaction costs

-

Simplified cross-border investing

Transparency and Security

The unparallel transparency of asset ownership and trade history through the blockchain technology. Every trade is logged on an immutable file.

This transparency offers:

-

Clear ownership records

-

Verified transaction history

-

Reduced fraud risk

-

Enhanced trust between parties

Current Applications of Tokenized Assets

A number of industries are already leveraging tokenized assets to great success.

Real Estate Tokenization

Real Estates tokenization is one of the greatest use cases! Platforms such as RealT and Fundrise let investors purchase tokens that represent shares of rental homes.

Benefits include:

-

Passive rental income

-

Property appreciation potential

-

Professional management

-

Portfolio diversification

Art and Collectibles

Art and collectibles of high value are being tokenized and we are having several investors own certain parts of them. Masterworks and Otis are platforms that make that possible.

This approach provides:

-

Access to blue-chip art

-

Potential appreciation

-

Cultural investment opportunities

-

Liquid art markets

Commodities Trading

Gold, silver and other commodities are being tokenized to make trading, storage and remittance easier. Digital Tokens about physical goods provide access without the physical ownership hassle.

Securities and Funds

Traditional securities, as stocks and bonds are known, are being tokenized so that they can be settled more quickly and traded around the clock. For private equity and hedge funds, this shift matters a lot.

Challenges and Considerations

Even though there are many good things about tokenized assets, there are also many problems to solve.

Regulatory Uncertainty

Policy on the regulation of tokenized assets is in a state of flux. Countries have different ways of doing things, and this diversity makes it hard for global platforms to comply with everything.

Key concerns include:

-

Securities law compliance

-

Tax implications

-

Cross-border regulations

-

Investor protection requirements

Technical Risks

Case in point, blockchain tech is secure, but this doesn’t make it risk-free. Trading is subject to the potential stability of smart contracts, network congestion and scalability.

Market Volatility

The value of tokenized assets may become highly volatile, especially during periods of adverse market conditions. Investors should consider these risks before investing.

Liquidity Concerns

While liquidity is better, there will continue to be challenges around liquidity in some tokenized assets, particularly in a down market or around niche assets.

The Technology Behind Tokenized Assets

The power of tokenized assets in trading can only be truly appreciated when the technology behind it is understood.

Blockchain Platforms

The majority of tokenized assets are based on existing blockchain platforms:

-

Ethereum: Top choice for tokenization

-

Polygon: Allows lower fees and faster transactions

-

Binance Smart Chain: Offers an alternative infrastructure “Binance Smart Chain is a finality Byzantine fault tolerance proof-of-stake chain,” according to the project’s white paper.

-

Solana: Known for high-speed transactions

Token Standards

Token standards are intended for different applications:

-

ERC-20: Basic fungible tokens

-

ERC-721: Non-fungible tokens (NFTs)

-

ERC-1400: Token standard for compliant security tokens

-

ERC-3643: Advanced security token standard

Custody Solutions

Tokenized assets simply cannot be securely stored in a fiat bank account, they need a custody solution designed specifically for such an asset class that blends the security of traditional finance with blockchain technology.

Future Outlook for Tokenized Assets

The future potential for digitalized trading in tokenized concepts is exciting and can benefit from some developing trends.

Institutional Adoption

Tokenized assets: major financial institutions are exploring them even more. Banks, investment firms, and insurance corporations Bitcoin even work in their tokenization plans.

Regulatory Clarity

Global governments are all taking steps to provide a clear regulatory landscape for tokenized assets, which will drive investor confidence and interest.

Technology Improvements

The developing blockchain space—particularly improved blockchain speeds and lower fees—will also make tokenized assets more appealing than ever.

Integration with Traditional Finance

We’re witnessing more convergence of tokenized assets and traditional financial systems, causing hybrid investment opportunities to emerge.

Trading with Tokenized Assets for Beginners

If you’re new to tokenized assets and digital investing, following a structured approach will help you trade safely and make informed decisions in the blockchain finance space.

Research and Educate Yourself

Start by learning the fundamentals of blockchain technology, tokenization, and crypto asset ownership. Understand how fractional ownership works and how digital securities represent real-world assets. Use online courses, tutorials, and guides to explore smart contracts, decentralized finance (DeFi), and secure trading platforms.

Choose Reputable Trading Platforms

Select established digital asset platforms that prioritize security, regulatory compliance, and custody solutions for crypto investments. Research platform performance, user reviews, and blockchain infrastructure. Trusted platforms help mitigate fraud risks and ensure smooth digital asset transactions.

Start with Small Investments

Begin with a modest allocation to understand market trends, liquidity, and trading mechanics. This approach allows you to gain practical experience with buying, selling, and lending tokenized assets without overexposing yourself to investment risk.

Diversify Your Digital Portfolio

Avoid concentrating all your funds in a single asset or token. Leverage tokenized ownership to diversify across real estate tokens, art and collectibles, commodities, or security tokens. Effective portfolio diversification reduces risk exposure and improves potential returns on investment.

Stay Updated on Market Trends and Regulations

The digital finance landscape evolves rapidly. Keep informed about changing regulations, blockchain upgrades, and market volatility. Staying updated helps you make strategic investment decisions and safeguard your digital asset portfolio.

Embracing the Digital Trading Revolution

Tokenized assets change the way we understand ownership and trading. They are providing opportunities for portfolio diversification, global market exposure and investment democratization like never before.

Although there are difficulties, the benefits can make tokenized assets well worth thinking about for today’s investors. With the developments in the technology and the clear regulations, we will witness tokenised assets as something more prevalent when it comes to digital trading.

So you could say that the secret of success is to learn technology, decide on the trusted venues and to keep our risks in check. But those who are open to this change yet somewhat cautious about the dangers inherent within it will be the best-positioned to take advantage of the opportunities multitrillion-dollar digital markets will offer.

Begin to browse tokenized assets today, but always do your homework and invest conscientiously. Modern finance is digital, and tokenized assets are a small part of that movement.

Conclusion: Why Tokenized Assets Are the Future of Digital Trading

Tokenized Assets Are Changing Digital Trading by redefining how ownership, liquidity, and access to investments work in the modern financial system. They break down traditional barriers, open global markets, and make premium assets accessible to a wider audience through fractional ownership. Blockchain technology ensures transparency, automation, and trust, while smart contracts reduce costs and inefficiencies.

Although regulatory frameworks and technical infrastructure are still evolving, the direction is clear. As institutions adopt tokenization and governments introduce clearer regulations, tokenized assets will become a mainstream component of digital finance. Investors who educate themselves, choose trusted platforms, and manage risk wisely will be best positioned to benefit from this rapidly growing market. Digital trading is no longer just about cryptocurrencies—tokenized assets are shaping the next era of finance.

FAQs: Tokenized Assets Are Changing Digital Trading

1. What does it mean that tokenized assets are changing digital trading?

It means traditional assets like real estate, stocks, and commodities are now being traded as blockchain-based tokens, making investing faster, more accessible, and more transparent.

2. How do tokenized assets differ from traditional investments?

Tokenized assets allow fractional ownership, 24/7 trading, faster settlement, and global access, unlike traditional investments that rely on intermediaries and limited market hours.

3. Are tokenized assets considered cryptocurrencies?

No. Cryptocurrencies are native digital currencies, while tokenized assets represent ownership of real-world or digital assets recorded on a blockchain.

4. Can beginners invest in tokenized assets?

Yes. Fractional ownership lowers entry barriers, allowing beginners to start with small investments and gradually diversify their portfolios.

5. What role does blockchain play in tokenized assets?

Blockchain provides transparency, security, immutability, and a decentralized ledger that records all ownership and transactions.

6. How do smart contracts support tokenized asset trading?

Smart contracts automate transactions such as ownership transfers, income distribution, and compliance enforcement without intermediaries.

7. What assets are most commonly tokenized today?

Real estate, art, commodities, stocks, bonds, private equity, and investment funds are among the most commonly tokenized assets.

8. Are tokenized assets legally regulated?

Regulation varies by country. Some jurisdictions treat them as securities, while others are still developing legal frameworks.

9. What risks come with tokenized assets?

Key risks include regulatory uncertainty, technical vulnerabilities, market volatility, and liquidity challenges for niche assets.

10. Can tokenized assets be traded globally?

Yes. Tokenized assets enable cross-border investing, allowing global participation with reduced friction and lower transaction costs.

11. Do tokenized assets improve liquidity?

Generally yes, since they can be traded digitally 24/7, though liquidity may vary depending on asset type and market conditions.

12. Why are institutions interested in tokenized assets?

Institutions see benefits in faster settlement, lower costs, improved transparency, and the ability to modernize traditional financial products.

The Future of Personal Finance: Autonomous Finance and AI Money Management

The Role of AI in Digital Financial Decision Making

What Is Financial Technology (FinTech)? Everything You Need to Know

What is a Fintech Firm? Everything You Need to Know

Digital Twin Technology in Finance: How Virtual Models Are Transforming Risk Management

The Future of Personal Finance: Autonomous Finance and AI Money Management

AI Credit Scoring: Revolutionizing SME Banking and Digital Loans

AI Fraud Detection: How Banks Prevent Financial Crime in Real Time